Bookkeeping is essential to modern businesses, particularly in maintaining financial accuracy, ensuring compliance, and making informed decisions. Outsourcing has become an increasingly popular option as companies seek to optimize their financial operations, reduce costs, and allocate resources more effectively.

This article offers businesses a thorough cost analysis and strategic insight into the benefits of outsourcing bookkeeping services. It provides a comprehensive overview of the costs associated with outsourcing bookkeeping services, including the initial setup costs, ongoing expenses, and total cost of ownership compared to building an in-house team.

Why Should Companies Outsource Bookkeeping

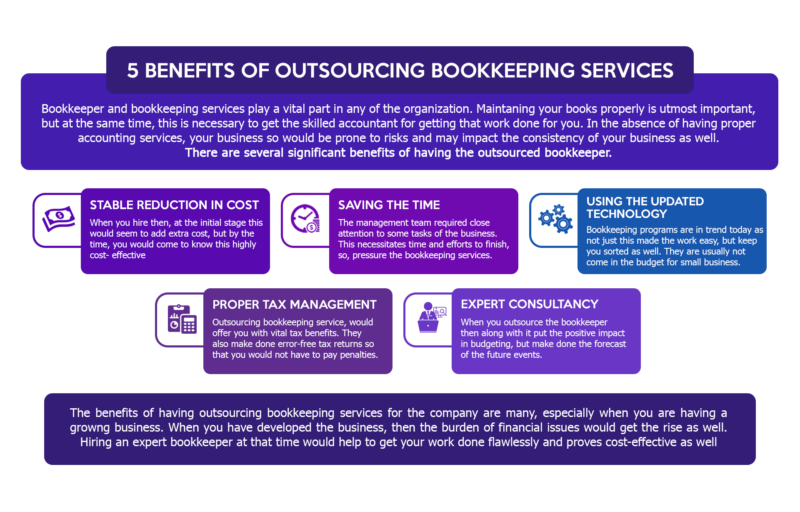

Opting to outsource provides a multitude of benefits for businesses, making it an attractive option for managing their financial operations:

Cost Savings

Outsourcing helps businesses avoid various costs linked to establishing and maintaining an in-house team. These costs include hiring new employees, such as recruitment and training expenses, and ongoing costs associated with employee compensation packages like salaries, benefits, and payroll taxes.

Additionally, outsourcing eliminates the need for allocating office space and purchasing or maintaining equipment specifically for the in-house bookkeeping team, resulting in further savings for the company.

Scalability

One of the significant benefits of outsourcing bookkeeping services is the flexibility it provides in terms of scaling services up or down to match the evolving needs of a business. As companies grow or contract, the financial management requirements will likely shift accordingly, and outsourcing providers can quickly adapt to these changes without incurring high costs. This scalability allows businesses to allocate resources more effectively and streamline their financial management processes, improving operational efficiency and reducing overall costs. Moreover, it enables companies to access a more extensive range of services or reduce the services they receive as per the changes in their financial management demands, providing greater agility in navigating an ever-changing business landscape.

This flexibility helps businesses adapt to growth or contraction without incurring additional costs or delays.

Focus on Core Competencies

By outsourcing their bookkeeping tasks, companies can effectively delegate financial management responsibilities to professionals while focusing on core business functions such as product development, marketing, and customer service. This approach frees up time, energy, and resources that would have otherwise been directed toward managing financial operations, allowing businesses to devote full attention to their primary business activities.

Additionally, outsourcing bookkeeping services provides access to specialized expertise and technology that would otherwise require investment and training to develop in-house. This way, businesses can concentrate on their strengths and allocate their resources effectively while ensuring that their financial operations are managed efficiently.

Ultimately, outsourcing bookkeeping services enables businesses to optimize their operational efficiency and maintain a competitive edge in the market.

What Impacts the Cost of Outsourcing Bookkeeping

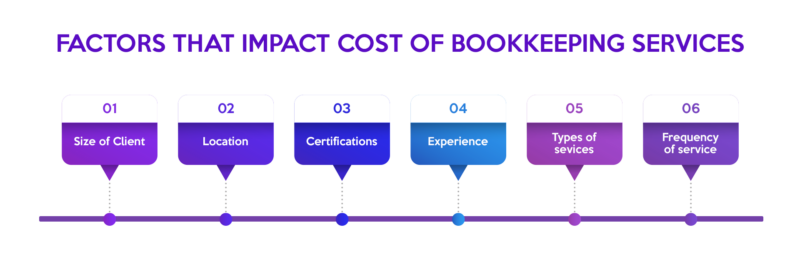

Numerous elements play a role in determining the expense associated with outsourcing bookkeeping:

Company Size

In the case of more giant corporations’ demand for more comprehensive services is generally more significant due to their complex financial operations and increased transactions.

Consequently, these companies will likely incur higher costs for outsourcing their bookkeeping needs. The service providers will have to dedicate more resources and expertise to manage the intricacies of the organization’s financial management.

Industry

Businesses operating within industries subject to stringent regulations may require specialized bookkeeping expertise to ensure compliance with all the relevant rules and guidelines.

In such cases, the cost of outsourcing bookkeeping services is likely to be higher due to the increased demand for professionals who possess a deep understanding of industry-specific regulations and the ability to maintain financial records in accordance with the regulatory framework accurately.

Geographic Location

Outsourcing providers situated in countries characterized by lower labor costs have the advantage of being able to offer more competitive rates to their clients. This is due to the reduced expenses associated with hiring and retaining employees, which allows them to pass on those savings in the form of more affordable pricing for their bookkeeping services.

As a result, companies that opt for these providers can benefit from cost-effective solutions without compromising the quality of their financial management processes.

Scope of Work

The overall cost of outsourcing bookkeeping services heavily depends on the range of services the business requires. This could span from basic data entry to more advanced financial management, such as financial reporting, tax preparation, and payroll management. Each of these services has a varying level of complexity and workload, and as such, it is reasonable to expect that the cost of outsourcing will increase as the scope of required services expands. By understanding the range of services your business needs, you can work with the provider to develop a custom pricing model that aligns with your needs and budgetary constraints.

Average Costs of Outsourcing Bookkeeping

Small Business

For small businesses with relatively straightforward financial operations, the cost of outsourcing bookkeeping services can range from $500 to $5,000 per month.

This cost typically covers basic bookkeeping tasks, such as managing accounts payable and receivable, reconciling bank statements, and preparing financial reports.

Mid-sized Business

For mid-sized businesses with more complex financial operations, the cost of outsourcing bookkeeping services can range from $500 to $7,500 per month.

The increased cost reflects the need for more comprehensive services, including additional financial reporting, payroll management, and tax preparation assistance.

Large Company

For large corporations with highly complex financial operations, the cost of outsourcing bookkeeping services can range from $2,000 to $10,000 per month or more.

This higher cost accounts for the extensive scope of services required, such as managing multiple accounts and currencies, handling intricate tax compliance issues, and providing detailed financial analysis and forecasting.

Direct Comparison of Outsourcing Bookkeeping vs. Building an In-House Bookkeeping Team

A direct cost comparison between outsourced accounting & bookkeeping and building an in-house team should consider initial setup costs, ongoing expenses, and total cost of ownership.

Initial Setup Costs

Outsourcing bookkeeping and accounting services comes with several advantages in terms of initial setup costs. Companies that choose to outsource can avoid recruitment or training expenses, have no need for office space and equipment allocation, and only need to engage a service provider on a one-time basis.

Conversely, building an in-house bookkeeping team involves recruitment and training costs for new employees, office space and equipment expenses, and potential costs for establishing or adapting internal processes and financial management systems.

Ongoing Expenses

Outsourced bookkeeping services also offer benefits in terms of ongoing expenses. Depending on the pricing model and scope of work, companies may pay hourly rates or fixed fees.

Additionally, they avoid incurring payroll taxes or employee benefits and only need to cover costs associated with extra services or ad-hoc requests. In contrast, an in-house bookkeeping team results in annual salaries ranging from $40,000 to $60,000 per full-time bookkeeper, payroll taxes, employee benefits, and additional costs for software licenses, subscriptions, and ongoing training.

Total Cost of Ownership

When considering the total cost of ownership, outsourcing bookkeeping services typically results in lower initial setup costs, more predictable and flexible ongoing expenses, opportunity cost savings from reallocating resources to core business functions, and access to specialized expertise without long-term investment. Outsourcing also provides scalability to accommodate changing financial management needs and volumes.

On the other hand, an in-house bookkeeper team incurs higher initial setup costs for recruitment, training, and infrastructure, fixed ongoing expenses in the form of salaries, benefits, and taxes, potential opportunity costs of dedicating resources to non-core functions, limited in-house expertise, and the need for additional investment for specialized skills or training. Finally, in-house teams offer less flexibility in scaling up or down in response to financial management demands.

Choosing the Right Bookkeeping Services Provider

Now that we’ve gathered all the costs to outsource social media marketing, how would you know which provider best fits your brand?

Before proceeding, we highly encourage you to check out The New Workforce. They provide well-equipped talents that specialize in accounting, bookkeeping, online marketing, IT support, customer services, and many more!

In the process of choosing a suitable bookkeeping service provider, businesses ought to take into account a range of important factors that can influence the quality and effectiveness of the services offered:

Experience

When searching for suitable bookkeeping service providers, it is essential to consider those with a well-established history of success, comprehensive knowledge of your specific industry, and a robust client portfolio that showcases their experience and capabilities.

By opting for a provider that meets these criteria, businesses can increase their confidence in the quality of the services rendered and enjoy the benefits of partnering with a reliable and experienced professional in the field of bookkeeping.

Technology

It is crucial to assess the technological capabilities of potential bookkeeping service providers, considering aspects such as their utilization of cloud-based systems, the extent to which they employ automation to streamline processes, and their ability to store sensitive data securely.

By ensuring that the provider is adept at using cutting-edge technology and maintaining stringent data security measures, businesses can benefit from increased efficiency, accuracy, and peace of mind knowing that their financial information is safe.

Communication

Maintaining effective communication is critical to fostering successful collaboration between a business and its bookkeeping service provider. As such, it is vital to evaluate the provider’s approach to communication, including their communication style, the promptness of their responses, and their availability for scheduling meetings or consultations when needed. By ensuring that the provider can engage in open and transparent communication, businesses can establish a strong working relationship that facilitates seamless cooperation and efficient handling of their bookkeeping needs.

Customization

It is essential to select a bookkeeping service provider or accounting partner capable of delivering customizable solutions specifically tailored to your company’s unique needs and requirements. By opting for a provider with such flexibility, businesses can ensure that the services they receive are optimized for their specific financial management needs, ultimately leading to more efficient operations and better overall results.

Security and Compliance

Verifying that the bookkeeping service provider adheres to stringent security protocols and consistently complies with all applicable regulations and industry standards is crucial. This diligence helps to safeguard your company’s sensitive financial data, protect against potential breaches, and ensure that the provider is equipped to handle any updates or changes to regulatory requirements, ultimately contributing to a more secure and reliable financial management partnership.

Reputation

Investigating the reputation of a potential bookkeeping service provider is an essential step in the selection process. This can be accomplished by exploring online reviews, analyzing client testimonials, and seeking recommendations from reliable sources within your professional network. By taking these measures, you can gain valuable insights into the quality, reliability, and effectiveness of the provider’s services, ultimately helping you make a well-informed decision for your company’s financial management needs.

Cost

Before making a final decision on a bookkeeping service provider, it is essential to compare the pricing models and associated basic bookkeeping costs among different options in the market. By conducting a thorough comparison, you can ensure that the chosen provider offers competitive rates and aligns with your company’s budgetary constraints and financial objectives. This approach will enable you to optimize the value of the bookkeeping services for your business while maintaining a healthy financial balance.

To sum it up, if you are a business owner, outsourcing bookkeeping services and accounting professionals offers numerous benefits for companies, such as cost savings, access to expertise, scalability, and compliance. When comparing outsourcing costs to maintaining an in-house team, outsourcing often presents a more cost-effective solution. By considering factors such as experience, technology, communication, customization, security, compliance, reputation, and cost, companies can select the right bookkeeping service provider to meet their specific needs.

Outsourcing bookkeeping and accounting needs enables businesses to optimize financial transactions and operations, reduce costs, and allocate resources more effectively. By conducting a thorough cost analysis and considering the advantages of outsourcing, companies can make informed decisions that ultimately contribute to their financial success and long-term growth.

Leave A Comment

You must be logged in to post a comment.