Outsourcing payroll involves delegating the task of processing salaries, wages, and other employee-related financial responsibilities to a third-party service provider. This practice is gaining popularity, enabling companies to focus on core business functions.

This article explores the benefits of outsourcing payroll, the steps involved, the factors to consider, tips for success, and potential challenges. It’s a comprehensive guide for anyone considering or already engaging in payroll outsourcing.

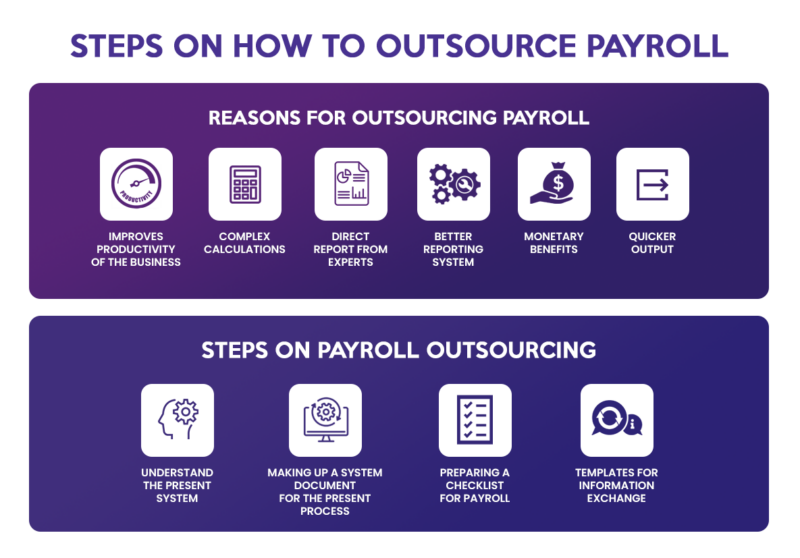

Benefits of Outsourcing Payroll

Cost Savings

Outsourcing payroll processing through a specialized payroll provider can lead to a significant reduction in the overheads that are typically associated with employing in-house staff to handle payroll services. This includes costs related to purchasing the necessary software and encompasses the ongoing expenses and complexities of maintaining legal compliance, particularly concerning payroll taxes. By leveraging the expertise of an outsourced payroll provider, businesses can efficiently manage these aspects without the need to invest heavily in internal resources.

Improved Customer Satisfaction

By focusing on timely and precise payroll processing, third-party payroll providers, specialists in payroll outsourcing services, can boost employee satisfaction. This meticulous approach to payroll management streamlines the compensation process and reflects positively on the company’s image. Engaging with skilled payroll outsourcing providers to oversee this critical function can increase employee trust and satisfaction, further enhancing the business’s reputation.

Access to a Larger Pool of Talent

By engaging with a payroll outsourcing provider, a company gains access to a wide and specialized talent pool that excels in managing payroll. This ensures that all payroll responsibilities are handled with the utmost expertise and precision. Choosing a skilled outsourced payroll provider means that the complex task of managing payroll is overseen by professionals dedicated to this specific function, assuring that the company’s payroll is administered with the highest degree of care and knowledge.

Improved Efficiency

By utilizing streamlined processes and employing cutting-edge technologies, a full-service payroll provider or payroll company can facilitate quicker processing times for payroll outsourcing work. This not only minimizes the potential for errors but also enhances the overall productivity of the payroll management process. The efficiency brought about by a professional payroll service provider ensures that the complex task of payroll administration is carried out with precision and speed, contributing to the smooth running of the entire business operation.

Compliance with Regulations

Professional payroll providers constantly update themselves with the newest legal and tax regulations about payroll management. Doing so ensures that the company adheres to all the necessary laws and requirements, maintaining full compliance. This attention to detail and commitment to staying informed not only safeguards the company against potential legal pitfalls but also significantly reduces the risk of encountering legal issues related to non-compliance.

Scalability

As a company grows and evolves, its payroll needs inevitably become more complex and expansive. Outsourcing provides a flexible solution for this growth, allowing for easy scalability that can adapt seamlessly to the company’s changing requirements. This adaptability means that the business can adjust its payroll functions through its development without significant internal alterations or investments. It creates a dynamic alignment between the company’s growth trajectory and its payroll management, ensuring a smooth transition through various stages of business expansion.

Focus on Core Business Functions

Businesses can free up valuable time and resources by entrusting the complex task of payroll to specialized providers with expertise in the field. This enables them to concentrate more intently on their core activities, such as product development, marketing, and strategic planning. In redirecting focus towards these essential functions, companies are often better positioned to foster growth and drive innovation. It creates an environment where creativity and strategic initiatives can thrive, contributing to the overall success and forward momentum of the businesses

Enhanced Security

Reputable outsourcing providers recognize the importance of safeguarding sensitive payroll data and, as a result, invest in state-of-the-art security measures and technologies. These advanced safeguards are meticulously designed to ensure the confidentiality and integrity of critical payroll information. By employing such rigorous security protocols, these providers demonstrate their commitment to data protection and significantly minimize the risk of unauthorized access, fraud, or breaches. It adds an extra assurance that the entrusted information will remain secure and uncompromised.

Disaster Recovery

Outsourcing firms typically recognize the critical nature of uninterrupted payroll processing and often invest in robust disaster recovery plans. These plans are comprehensive and designed to ensure payroll processing continues without interruption, even during unexpected and disruptive events. Whether it’s natural disasters such as floods or earthquakes, or technologically driven threats like cyber-attacks, these disaster recovery strategies provide a resilient framework that safeguards the continuity of payroll services. Preparing for unforeseen challenges offers peace of mind that payroll obligations will be met regardless of circumstances.

Customized Solutions

Many outsourcing providers offer tailored solutions to fit a business’s unique needs and preferences, providing flexibility and personalized service.

Steps for Outsourcing Payroll Effectively

1. Define Your Payroll Needs

Begin by identifying the specific payroll functions and requirements that must be outsourced to a specialized provider. This involves a detailed analysis and understanding of various aspects of your company’s payroll system, including the complexity of the tasks, the frequency with which they must be performed, and the particular compliance needs that must be met. By taking the time to assess these elements carefully, you can create a clear and comprehensive picture of your payroll outsourcing needs, ensuring that the selected provider will be equipped to handle them efficiently and accurately.

2. Research Outsourcing Options

Take the time to investigate various payroll service providers that cater to your specific needs. This research should thoroughly examine key factors such as their reputation in the industry, the level of expertise they bring to the table, the technologies they utilize to ensure efficiency, and their pricing structures. By evaluating these aspects, you can gauge the compatibility of potential providers with your organization’s requirements and budget, ensuring that you make an informed decision that aligns with your overall business objectives and payroll management needs.

3. Develop a Clear Communication Plan

Take the time to carefully formulate communication guidelines between your business and the selected payroll provider. This should involve outlining clear communication channels, setting expectations for responsiveness, and defining the processes for sharing information.

Establishing these guidelines ensures that both parties are aligned in their understanding and approach, leading to smooth interactions and a more cohesive working relationship. It lays the foundation for transparent and effective communication for a successful outsourcing partnership.

4. Assess Security Measures

Carefully evaluate the security protocols and data protection measures implemented by potential payroll providers under consideration. This assessment should include a close examination of their practices and technologies designed to safeguard sensitive information, as well as their compliance with relevant legal and regulatory standards. By taking this vital step, you can maintain the confidentiality of critical and sensitive payroll information, mitigating the risk of unauthorized access or breaches. It’s a key aspect of due diligence that reinforces trust and confidence in the chosen provider’s ability to securely handle your organization’s unique payroll needs.

5. Implement and Monitor the Outsourcing Process

Take the necessary time to carefully plan the transition to the chosen payroll provider, considering all aspects of the process to ensure a smooth handover. Along with a detailed transition plan, it is essential to establish specific performance indicators or key performance metrics that align with your company’s expectations and goals. These metrics will enable you to regularly monitor and evaluate the provider’s effectiveness in handling your payroll needs. By setting clear standards and regularly assessing performance against them, you can maintain an ongoing, productive relationship that fulfills your organization’s payroll requirements efficiently and professionally.

6. Conduct Regular Compliance Checks

Collaborate closely with the chosen payroll provider to ensure that all legal and tax obligations related to payroll are continuously met and fully compliant with the applicable laws and regulations. This may include setting up regular meetings to review compliance status, establishing clear reporting procedures, and conducting regular audits to verify adherence if necessary. By maintaining open communication and vigilant oversight, you can create a partnership that fulfills the immediate payroll needs and upholds the legal and ethical standards vital to your organization’s reputation and success.

7. Foster a Collaborative Relationship

Work diligently to build a strong, lasting relationship with the payroll provider, actively encouraging collaboration and partnership. This involves open communication, mutual understanding, and alignment with shared objectives. You can create a more cohesive and synergistic partnership by fostering a relationship beyond mere transactional interactions and by ensuring that both parties are working towards common business goals. This harmonious collaboration can increase efficiency, provide a better understanding of needs, and a more tailored approach to your organization’s specific payroll requirements.

Factors to Consider When Outsourcing Payroll

Quality of Services

Assess the overall quality of the provider’s services, considering factors such as accuracy, timeliness, and adherence to agreed-upon standards and expectations. Look for consistency and reliability in their delivery to ensure that they meet your organization’s specific payroll process needs.

Availability and accessibility

Verify that the provider is available when required and can be easily reached through various communication channels. Consider their responsiveness and ability to provide support during critical times to ensure a smooth and uninterrupted working relationship.

Cost

Take into account the total cost of engaging with the provider, including not only the upfront charges but also any hidden fees, ongoing expenses, and the long-term value they bring to your organization. Evaluate how their pricing aligns with your budget and financial expectations.

Cultural Compatibility

Ensure that the provider thoroughly understands your company’s culture, values, and operational philosophy. Assess their ability to align with these elements and adapt to how your organization functions. This alignment can play a crucial role in building a harmonious and productive partnership.

Tips for Successful Payroll Outsourcing

Foster Open and Clear Communication

Establishing and maintaining clear communication lines between all involved parties are crucial for successful collaboration. This includes setting expectations, defining roles, and ensuring transparency, all of which contribute to a more effective and harmonious working relationship.

Maintain a consistent brand voice

Work closely with the provider to ensure that they fully understand, embrace, and reflect your company’s unique values, culture, and brand voice. This alignment is vital for conveying a consistent and authentic image to your stakeholders.

Use Technology to Your Advantage

Leverage the latest technology and tools available to facilitate efficient processing, reporting, and analysis within the payroll function. This includes identifying platforms and systems that align with your specific needs and can enhance productivity and accuracy.

Continuously evaluate and improve the outsourcing process

Implement a systematic approach to regular evaluation, feedback, and continuous improvement within the outsourcing process. By actively seeking ways to enhance performance and aligning efforts with evolving business objectives, you can create a more adaptive and responsive payroll function that meets the changing demands of your organization.

Potential Challenges of Outsourcing Payroll and How to Overcome Them

Language Barriers

Select providers that have demonstrated proficiency in your business’s primary language or languages. Ensure that they can effectively communicate and understand your specific needs, thus minimizing misunderstandings and enhancing collaboration.

Time Differences

Carefully coordinate schedules with the provider, taking into account any time zone differences, to ensure availability and responsiveness during your standard business hours. This planning helps maintain a smooth workflow and enables timely communication and decision-making.

Maintaining Control Over the Customer Experience

Establish and articulate clear expectations with the provider, outlining the desired outcomes, performance standards, and specific responsibilities. Maintain active oversight and regular check-ins to ensure control over the customer experience, safeguarding quality, consistency, and alignment with your business’s values and goals.

Outsourcing payroll offers numerous benefits, including cost savings, efficiency, and access to expertise. Following a thoughtful process ensures success.

Final Thoughts on Making a Successful Outsourcing Decision

Careful consideration of all factors, ongoing communication, and regular evaluation will make outsourcing payroll a strategic advantage for your company. Whether small or large, any organization looking to streamline its payroll function will find value in this approach.

Leave A Comment

You must be logged in to post a comment.