Running a small business is no easy task. There are a lot of moving parts to keep in motion, including payroll processing. As a business owner, payroll is critical to keeping your staff paid and happy. Hiring, training, and paying for an in-house payroll services department is expensive and time-consuming.

By outsourcing to a third-party payroll processing company, you don’t need to go through the trouble of creating a team in-house. This puts you back where you belong in the driver’s seat of your company. Throughout this guide, we’ll give a more in-depth look at the benefits and outcomes, along with how much it costs to outsource payroll.

Why Should You Outsource to a Payroll Company?

Payroll is an important part of any company. Without this team, your employees don’t get paid, and company finances are put in turmoil. The payroll process doesn’t just ensure paychecks go out on time, they also organize payment information for tax purposes.

If you’re considering outsourcing to a payroll company, here are a few advantages to doing so.

Time Savings

Time might as well be currency where business owners are concerned. Every minute spent away from your main task or priority, is time lost. Organizing and distributing payroll takes energy you don’t need to expend. Some of the ways you save money by outsourcing include cutting:

- New framework development

- Initial training

- Training upgrades

- Candidate vetting and interviews

- Performance reviews

All the time you save on these tasks is better spent managing your brand, and dealing with other areas of your company.

Reduced errors

People make mistakes, especially dealing with new training and a new position. Hiring a third-party company to manage payroll ensures everything is handled by experienced payroll professionals.

Errors in payroll are never good for a company. They reflect poorly on the business image and cause problems with employees. The fewer errors dealing with your team’s salary, the better. Outsourcing takes the onus off you and delegates the heavy lifting to the experts.

Access to expertise

Payroll companies specialize in accounting and train their staff with the latest and most up-to-date industry information. Business owners, unless they’re in the business of payroll, don’t have the same ongoing expectations and training regimens for employees.

By working with a third-party payroll specialist, you gain access to all the tools, support, and experience of your new payroll service providers. Their skills become your skills because their team becomes an extension of your own.

Fewer Training Requirements

Training is one of the biggest time constraints of hiring new employees. It takes a long time to train new talent to meet company standards and outsourcing minimizes these concerns. Talent is:

- Pre-vetted

- Interviewed

- Trained

All this happens before you even provide details of your company needs to your third-party payroll partner. That company then brings its candidates up to speed on specifics. In this way, outsourced employees become an extension of your own company without the need for new training materials, training managers, or paid training.

Ease of Expansion

Expanding your brand takes a lot of planning and new staff to fill out the team. Outsourcing simplifies the process by eliminating the need to take on new payroll staff. Simply explain to your third-party service you would like to add to the team, and they oversee the entire process.

- No calling references

- No adjusting your budget for new salaries with benefits, vacation, and sick time

- No training new hires

Your role remains firmly in place managing your brand and overseeing the expansion.

What Impacts the Cost of Outsourcing Payroll?

Nothing comes for free, and payroll is no different. As you begin building your company, and the need for a dedicated payroll team arises, it’s time to consider your options. Should you go with an in-house team or outsource? This is a tough choice and one that once again has heavy financial implications.

There are many factors impacting your payroll services cost. Some of the most common contributions to a budget are the following.

Payment Frequency

Believe it or not, the number of times you pay your employees every month impacts the payroll cost. Why? Because every time you process a payment, there’s a payroll processing fee. There are checks to print.

Companies that pay once a month will be charged less for payroll outsourcing than those that pay bi-weekly or weekly.

Size of the company

The number of employees you have directly relates to payroll cost. This is because the larger your workforce, the more employees you’ll require to oversee pay.

Companies with a large number of employees need more staff, and those staffs require a supervisor or manager. There are a lot of moving parts involved. Fortunately, by outsourcing, you relieve much of the responsibility of delegating roles like payroll manager. Your third-party service will see to that.

Level of service needed

The services you require of your payroll staff also impact payroll cost. Some of the most common services include:

- General payroll service

- Worker’s compensation claims management

- Tax deductions

- Compliance

- Tracking and reporting

- Direct deposit

The more services you add on, the greater your payroll cost could be. Some third-party payroll companies create customized packages for clients. You can work with your third-party service to find the right fit for your brand.

Location

Outsourced payroll happens in two ways, domestically or internationally. Outsourcing partners located within the United States generally cost more, but with these payroll costs comes the expertise of American employees.

Outsourcing internationally is often cheaper. Pay scale laws differ by country. The amount you’ll pay depends entirely on where your third-party service is located or allocates your payroll team.

Availability

Like all businesses, overtime is costly. Outsourcing is no different in this regard. When you outsource to a third-party payroll service, you’ll pay less for a basic package of 9 to 5 business hour coverage. For 24/7 access to your payroll team or other overtime scheduling, you’ll pay more.

Some third-party payroll services offer 24/7 packages as a regular incentive. Shop around to find the right hours of availability for your brand.

Customization

Bespoke payroll services are more costly than a basic package. Sometimes these customizations are necessary to ensure your third-party provider meets your company’s standards.

Some outsourcing partners are happy to include minor customizations in the cost of your package. Others allow for add-ons like direct deposit at an additional cost.

Contract duration

Contracts are a key factor in the cost of any outsourcing partnership. These payroll companies want to know if their services are going to consistently bring in revenue. Long-term contracts guarantee sustainability as a company. Many outsourcing businesses provide services at reduced payroll costs to companies that sign long-term.

There are plenty of short-term options out there if you shop around. You’ll pay more, but in the end, you should go with the right partner and package for your company.

Average Costs to Outsource Payroll

Payroll differs from other outsourcing because a lot of the process is performed through automation. You don’t need one payroll employee per employee in your company, or one payroll employee per 10 customers, as you would with sales or customer service. This makes it significantly cheaper.

On average, you can expect to pay roughly $250 per employee every year. This includes payroll processing fees, a base rate, and ongoing service costs. Most outsourcing partners charge a fixed rate or a per-employee per-month (PEPM) rate. This ebbs and flows with your number of employees.

- Small businesses: A company with 1 to 9 employees will pay roughly $80 to $120 a month.

- Mid-sized companies: A company with 10 to 19 employees will pay roughly $125 to $170 a month.

- Large corporations: A company with 20-plus employees will pay $175 and up per month.

The above calculations include a base rate of $75 per month and a $5 per employee charge on a PEPM service. This changes depending in the base rate and PEPM cost of your partnering service.

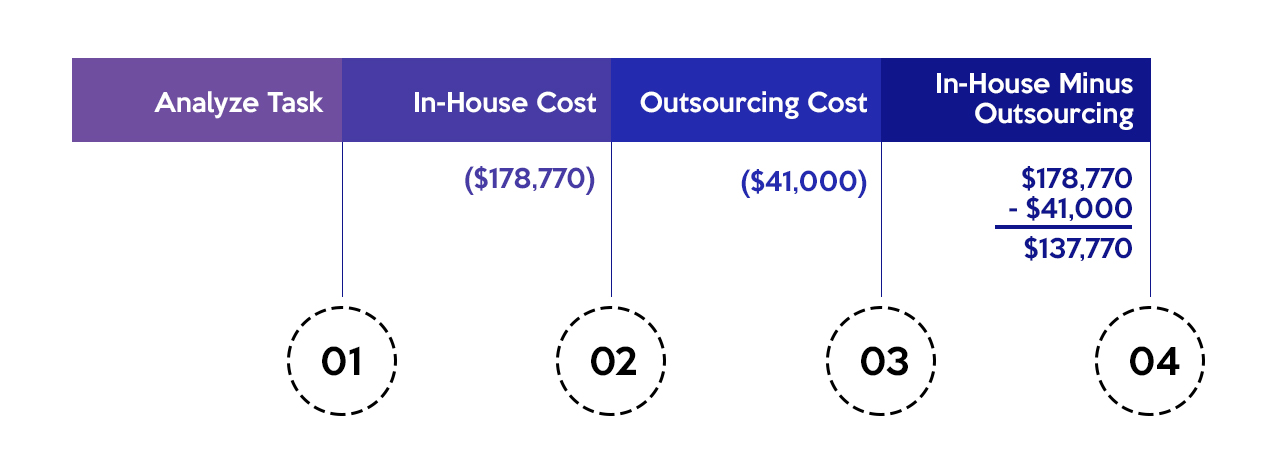

Outsourcing Customer Service vs. In-House Payroll – Direct Comparison

According to Glassdoor, a U.S. payroll specialist can expect a salary of about $52,667 per year. This is an approximation of the amount you’d pay for one payroll specialist. If you run a medium or large company, you’d likely require more.

Outsourcing by these standards is much cheaper. For a small business, especially, it often makes sense to outsource, rather than hire in-house.

Here are some other payroll costs comparisons outside of salary to help you make your decision.

Initial setup payroll costs

Setting up a payroll department requires workspace, software, and of course talent. Setting up with an outsourcing company generally comes with a base fee to register, and ongoing monthly payments for the package you select.

Here’s a brief breakdown of initial startup fees for an in-house team:

- New software: $500 – $1,000

- Office space: $20,000 – $45,000

- Computers: $1,000 – $2,500

- Talent acquisition: Up to $33 per hour of human resources

There’s also the cost of office furniture, onboarding documents, setting up direct deposit, and of course training to contend with.

Ongoing expenses

Along with the initial cost to start your payroll department in-house, you’ll encounter ongoing expenses. These payroll costs continue throughout the lifespan of your business.

- Salary: $52,667 annually

- Training: The cost of training varies depending on the tools and employees required to complete the task.

- System maintenance: Up to 5% of the value of your equipment goes into maintenance each year.

- Payroll manager: $77,481 annually

- Some of these costs may not be required for smaller businesses. A payroll manager, for example, is usually only necessary if multiple payroll specialists are on staff.

Total cost of ownership

Tallying all these costs gives you an overall estimate of $164,148 per year based on one payroll specialist and one payroll manager. Tack on an additional $52,667 for each additional payroll specialist, and remember to add new computers and office furniture for them as well. This number gets big quickly.

Choosing the Right Payroll Outsourcing Partner

Price is important, but it isn’t everything. When you select third-party payroll providers, you need to choose someone that works well with your brand. They become an extension of your company, and matching company culture is important.

One of the top payroll providers in outsourcing is The New Workforce. This experienced outsourcing partner offers some of the best pre-vetted, qualified payroll specialists in the industry. Their team comes trained in the newest payroll methods and software protocols. The company also specializes in customer service, sales, IT, and digital marketing.

Reputation and experience

The experience of your payroll provider is critical to the flow of your business operations. Payroll is important on many levels. If employees aren’t being paid, they don’t want to work. Therefore, minimizing hiccups in the system is beneficial to you.

An experienced outsourcing provider with a good reputation in timely payroll practices minimizes these risks.

Quality of service

Quality is crucial in every aspect of business, especially when crunching numbers. While many payroll practices are automated through specialized software, there’s still plenty of room for human error. Having well-trained, experienced payroll specialists increase the quality of service to your company.

As you consider different outsourcing venues, look at things like:

- Experience

- Business protocols for rewards and repercussions

- Training

- Upgraded training options

- Language and country of origin

Consistency is crucial for any payroll department. When you choose an outsourcing company with high-quality standards for their employees, you gain more consistency in service level.

Integration with existing systems

Every company has their own systems and software used to carry out daily tasks. When you partner with a payroll provider, you want to ensure their system is compatible with your own.

You don’t want to spend hours and money uploading, downloading, and purchasing a new software. Find a team that uses platforms to complement your own, not the other way around. If a potential candidate isn’t willing to be flexible, it might not be the best fit.

Customer support

You’re the customer in an outsourcing situation. Payroll providers should offer top-tier customer service. What type of support are you getting? Look at things like:

- Hours of availability

- Languages available (English, Spanish, French, etc.)

- Type of support offered (In-person, call center, email, and chat, etc.)

Take this opportunity to speak with someone from the payroll department before partnering with an third-party payroll provider.

People

How large is the staff of the outsourcing provider you’re considering? Do they have room for growth if you decide to expand later? How many clients are they serving now? These are all great questions because they tell you whether your company will be fully supported. The size of your outsourcing partner also impacts the cost of payroll outsourcing.

Processes

The processes used by your payroll partner matter. This goes hand in hand with the services offered but involves a more detailed outline of methods used. Things like software, data collection methods, problem solving capabilities, and even what is done manually or by automation.

In this guide to payroll outsourcing we’ve talked about a lot of things that impact cost and productivity. Some of the main takeaways include:

- Saving time

- Easier expansion opportunities

- Less training

- Reduced costs

- Fewer errors

Outsourcing also means you’ll pay less for office space, equipment, software, maintenance, furniture, talent acquisition, and salaries.

When you compare the costs of an in-house team with that of outsourcing a payroll department the numbers are drastically different. This is one area of business where outsourcing certainly pays off financially. Overall, the cost to your company depends on several factors. Fortunately, many outsourcing payroll providers are willing to customer packages to fit their client’s needs.

If your business is growing and managing employee payroll is becoming a daunting task, it’s time to hire a professional. Whether you go in-house or outsource is a personal decision. Whatever path you take, look for someone that fits your company culture and your budget.

Leave A Comment

You must be logged in to post a comment.