As we navigate through the fast-paced, ever-evolving commercial landscape of the 21st century, businesses continuously aspire to innovate, boost operational effectiveness, curb expenditures, and deliver unparalleled value. Accounting, a vital cornerstone of any enterprise, has seen a revolutionary shift in recent times.

A growing cohort of firms are embracing Business Process Outsourcing (BPO) for their accounting functions, paving the way for a new age of fiscal prudence and precision.

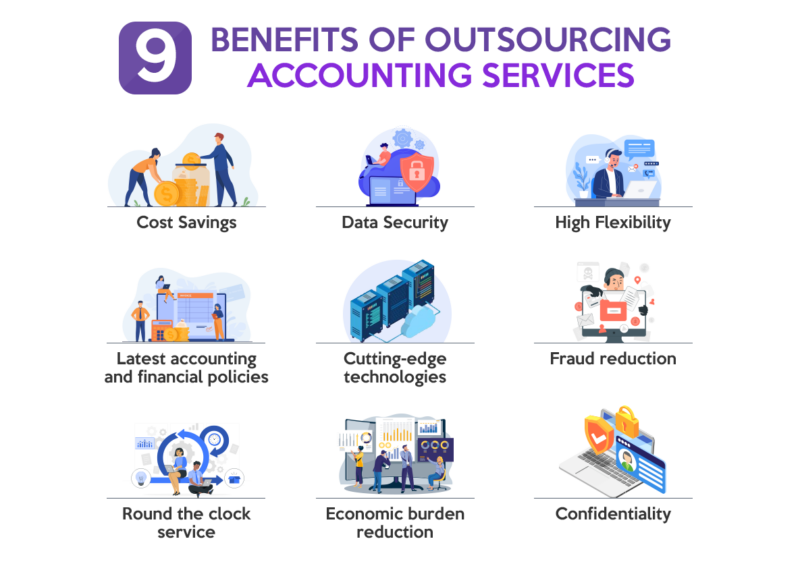

This article explores the manifold reasons why integrating BPO into your accounting process could fundamentally transform your business landscape.

1. Cost Efficiency

It could be reasonably asserted that the most significant advantage of utilizing Business Process Outsourcing (BPO) for accounting is its potential for substantial cost efficiency. The essential premise of BPO is that it enables companies to delegate their accounting tasks to external service providers who specialize in this particular field.

In doing so, businesses significantly lessen the burden of sustaining a comprehensive, fully operational in-house accounting department. Rather than bearing the overhead costs associated with hiring full-time accountants, providing them with many employee benefits, continually investing in their professional development through training, and acquiring and maintaining the latest accounting software and hardware, businesses can now allocate these resources more strategically elsewhere.

By entrusting their accounting responsibilities to a BPO, businesses can essentially convert a substantial portion of their fixed costs into variable costs. The cost associated with the accounting function is no longer constant but fluctuates according to the scale of the tasks undertaken by the BPO. This shift in cost structure allows for a more efficient allocation of financial resources and further drives operational savings.

2. Access to Specialized Expertise

Through the strategic decision to delegate BPO financial accounting work, companies unlock the valuable opportunity to leverage the expertise and experience of a dedicated team of financial specialists. These seasoned professionals are not just employees of the BPO firm but are astute individuals steeped in the discipline of accounting, boasting both wide-ranging knowledge and deep sector-specific insights.

The accounting realm is a vibrant and fast-evolving field, constantly adapting to new financial regulations, evolving tax laws, and innovative accounting practices. These external accounting experts are committed to staying up-to-date with these changes. Their keen focus and technical understanding ensure that they are consistently ahead of the curve regarding the latest developments and standards in the financial industry.

This constant pursuit of knowledge is invaluable to businesses that engage BPO services for their accounting needs. It ensures that the company’s financial statements and financial reporting are managed with utmost competence and conformity. The outsourced accounting team adheres strictly to the newest regulations and best practices, guaranteeing that your organization’s finances are in good hands and the best hands.

3. Scalability

One of the standout benefits of engaging Business Process Outsourcing (BPO) providers is their inherent ability to offer highly adaptable and scalable solutions, uniquely suited to accommodate the fluctuating requirements of a business. The nature of business itself is inherently dynamic, often undergoing various growth, contraction, and transformation stages. BPO providers excel in this area, offering the ability to fine-tune the scale and scope of their services in line with these evolving business needs.

Whether a business finds itself in a phase of rapid expansion, necessitating the acceleration of accounting tasks, or in a period of contraction, which may require a scaling back of services, BPO providers are uniquely equipped to adjust their offerings. This degree of flexibility can be particularly invaluable for certain types of businesses.

For instance, seasonal businesses that experience significant fluctuations in activity throughout the year can immensely benefit from such adaptable services. During peak periods, they can ramp up the accounting support to handle the increased workload, while in off-peak periods, the services can be dialed back to align with the reduced requirements. This elasticity prevents the business from being burdened by a hefty permanent accounting department that may be underutilized during slower periods.

4. Focus on Core Competencies

Outsourcing accounting services to a third-party service provider, such as a Business Process Outsourcing (BPO) company, allows client businesses to devote their full attention to their central areas of expertise – their core competencies. In the intricate web of business operations, accounting is undeniably critical but can be time-consuming and complex. When these tasks are outsourced to a BPO service provider, it alleviates the pressure from the internal team, freeing them from the shackles of intricate accounting tasks.

When a client company chooses to outsource, it liberates the company’s resources and allows them to focus on what they do best. Instead of becoming enmeshed in the minutiae of accounting tasks, business leaders and their teams can shift their attention towards strategic planning, a crucial factor driving the direction of any company. Freed from the constraints of financial management, these leaders can harness their creativity and expertise to develop more effective business strategies and long-term plans.

Moreover, the outsourcing decision opens up space for the client company to concentrate on enhancing their products or services. With the assurance that their accounting functions are in the capable hands of the outsourcing provider, they can channel their efforts into research and development, refining their offerings, and delivering superior value to their customers. This relentless pursuit of improvement fuels a culture of excellence, propelling the business to new heights in their industry.

5. Improved Accuracy

Accuracy in maintaining financial reports and records is not just an administrative necessity, but an imperative that directly impacts various aspects of a business’s operations. From informed decision-making to ensuring regulatory compliance, accurate financial records play a pivotal role. Business Process Outsourcing companies, or BPOs, specializing in accounting are renowned for their unwavering commitment to precision, thanks to their extensive expertise, technologically advanced tools, and meticulous quality control measures.

These BPO service providers, acting as third-party service providers, are steeped in financial and accounting acumen, developed over years of catering to diverse industries. This depth of knowledge equips them to handle even the most complex financial tasks with a high degree of precision. Additionally, they continuously upskill their staff through training and development programs, ensuring that their teams are always at the forefront of accounting practices and regulatory changes.

Coupled with their expertise, these outsourcing providers employ cutting-edge tools and software to manage their clients’ financial records. Leveraging advanced technology not only streamlines the accounting process but also enhances its accuracy. Automation reduces the potential for human error, while advanced features like real-time tracking, data analytics, and audit trails provide additional layers of control and precision.

Furthermore, BPOs uphold rigorous quality control measures, instilling a culture of precision and accountability. Regular audits, reviews, and validations are part of their standard operating procedures, further ensuring the accuracy of their output. Any discrepancies or potential errors are identified and rectified promptly, minimizing the risk of inaccurate financial reporting.

The relationship between a client company and the BPO service provider is typically governed by a service level agreement (SLA). This agreement outlines the expectations and deliverables, including the degree of accuracy required in the financial tasks undertaken. Thus, the BPO is contractually obliged to adhere to the highest standards of accuracy, reinforcing their commitment to precision.

This unwavering focus on accuracy can significantly reduce the risk of errors in the client company’s financial records. Any inaccuracies in these records can lead to regulatory penalties, due to non-compliance with financial regulations, or can result in faulty business decisions based on erroneous data. By ensuring high levels of precision in their financial tasks, BPOs shield the client company from these potential risks.

6. Advanced Technology

The continuous evolution of technology has a significant impact on various sectors, and accounting is no exception. The introduction of advanced accounting software has revolutionized the way businesses manage their financial operations, enhancing both efficiency and accuracy. However, investing in the latest accounting software can be an expensive and time-consuming endeavor for many companies. Fortunately, Business Process Outsourcing companies, or BPOs, already have access to these state-of-the-art tools and systems, and can offer companies a cost-effective and efficient solution.

With their finger on the pulse of technological advancements, BPOs and professional accounting firm invest heavily in the latest accounting software and tools. This commitment ensures that they can provide their clients with the best possible service, leveraging innovative features to automate tasks, streamline processes, and enhance accuracy. The latest software also allows BPOs to generate real-time reports and data, providing businesses with valuable insights into their financial performance.

When a company chooses to engage a BPO for their accounting needs, they gain access to this suite of advanced technologies without having to make a direct investment. The cost of acquiring, implementing, and maintaining the latest accounting software can be prohibitively high, especially for small to medium-sized businesses. Add to this the time and resources required to train staff on the new software, and the process becomes even more burdensome.

By leveraging BPO services, companies can bypass these challenges. They can utilize the latest technology to manage their accounting processes, from payment processing to tax preparation, without having to navigate the complexities of software acquisition and implementation themselves. This approach not only saves time and resources but also ensures that companies can stay at the forefront of technological advancements in accounting.

7. Data Security

Despite prevalent misconceptions, the process of outsourcing can significantly bolster the security of sensitive data. High-quality Business Process Outsourcing (BPO) firms are recognized for their rigorous adherence to stringent data protection protocols, ensuring the security of sensitive financial information. Interestingly, the data security measures instituted by these BPOs often surpass those that a standard small to medium-sized business could deploy independently.

When it comes to protecting sensitive financial data, it’s no secret that the stakes are high. Data breaches can result in substantial financial losses and damage to a company’s reputation. This is why reliable BPO firms prioritize data security and implement strict measures to safeguard their clients’ sensitive information. The strategies used by these firms often combine physical, digital, and procedural methods to create a comprehensive defense against potential threats.

BPO firms employ advanced security software and encryption tools to protect digital data. Such tools often include firewalls, intrusion detection systems, and data encryption software. These applications work together to protect financial data from various cyber threats, from phishing and ransomware attacks to data breaches and unauthorized access.

8. Round-the-clock Service

Business Process Outsourcing (BPO) firms are typically characterized by their 24/7 operational schedule, guaranteeing the punctual execution and submission of accounting responsibilities. This round-the-clock service delivery model is of immense value for companies that span multiple time zones or those requiring continuous access to the most recent financial information. The presence of dedicated accounting staff, working in shifts to cover all hours, ensures that these essential tasks are handled efficiently at all times.

The operational nature of BPO firms means that they are not restricted by traditional business hours. Instead, their services run continuously, 24 hours a day, seven days a week. This consistent availability allows for the prompt completion of accounting tasks, regardless of the time of day. With a team of skilled accounting staff working around the clock, BPO firms can ensure the timely delivery of services, meeting the demands and expectations of the businesses they serve.

9. Better Decision-making

With accurate and timely financial data provided by BPOs, business leaders can make informed decisions. Outsourcing firms also offer financial insights and advisory services based on their understanding of financial trends and data, which further aids the decision-making process.

10. Enhanced Compliance

With the ever-evolving financial regulations and tax laws, compliance can be a complex and challenging task. BPOs ensure adherence to these regulations, minimizing the risk of non-compliance and the associated penalties.

In summary, BPO for accounting offers numerous advantages that can transform your business. From cost savings to improved accuracy, access to expertise, advanced technology, and enhanced focus on core operations, outsourcing can be a strategic move for businesses seeking growth and efficiency. However, it is essential to choose a reputable BPO provider that aligns with your business needs and objectives, as the right partnership is key to realizing the full potential of accounting outsourcing.

Leave A Comment

You must be logged in to post a comment.