Outsourcing your bookkeeping can be a transformative strategic decision, enabling your organization to enjoy improved efficiency, substantial cost savings, and access to a larger talent pool. This article provides an in-depth guide on outsourcing bookkeeping effectively to achieve enhanced financial data management and financial reporting for your business.

Benefits of Outsourcing Bookkeeping

Outsourcing bookkeeping services offers a host of benefits which can significantly contribute to the growth and efficiency of your business.

Cost Savings

One of the primary reasons to outsource bookkeeping is the potential for significant cost savings. Keeping an in-house bookkeeper or maintaining an accounting team can be costly, particularly for small businesses. There are salaries, benefits, training costs, and not to mention the time you must spend managing this function. Companies can redirect these resources toward core business operations by outsourcing bookkeeping.

The cost savings extend beyond the direct reduction in payroll. Using an outsourced bookkeeping service, business owners can save on software costs. With outsourced bookkeeping, businesses only pay for the bookkeeping services they need. They can scale up or down as required, leading to considerable savings. According to Salary.com, the average annual Bookkeeper salary in the United States is $43,237, while according to Glassdoor.com, the average yearly salary for accountants is $67,601. It’s a substantial difference between the two, and it just says more about how much you can save from outsourcing your bookkeeping.

Improved Efficiency

Efficiency is at the heart of every successful business operation. You invest in streamlined and accurate financial statements when you outsource your bookkeeping. Most outsourcing companies utilize efficient bookkeeping software, which reduces the likelihood of human error and increases speed, leading to more efficient financial reporting.

Outsourcing bookkeeping tasks also leads to better use of time. By allowing experts to handle your financial data, you free up your own time or your staff’s time, allowing you to focus on what you do best – running your business. Whether improving your products, expanding your services, or enhancing customer experience, outsourcing can lead to overall business efficiency.

Access to a Larger Pool of Talent

When you outsource bookkeeping, you’re not limited to the skill set of a local bookkeeper or the knowledge of freelance bookkeepers. Outsourcing companies often have a diverse team of professionals, each with unique skills and experiences. This breadth of expertise is particularly advantageous in complex areas such as tax preparation, estimated tax payments, and accounts receivable management.

Also, a dedicated bookkeeper from an outsourcing company stays abreast of the latest changes in tax laws, financial regulations, and best practices in financial reporting. As a business owner, you gain access to a broader pool of talent and expertise, thereby improving the quality of your financial records.

Enhanced Customer Satisfaction

While outsourced bookkeeping services seem like a behind-the-scenes business function, they can directly impact customer satisfaction. Accurate and timely financial data can lead to better business decisions, improving your products or services and directly impacting the customer experience.

For example, influential accounts receivable management can result in smoother client transactions. Prompt and accurate billing and clear financial communication can enhance their experience with your company, leading to higher customer satisfaction.

Moreover, outsourcing your bookkeeping allows you to respond to financial queries rapidly. A good outsourcing company can provide quick responses to questions about invoices, payments, and accounts. This faster response time can significantly enhance customer satisfaction, increasing customer loyalty and repeat business.

Outsourcing bookkeeping allows businesses to save costs, improve efficiency, access a larger talent pool, and enhance customer satisfaction. By outsourcing, business owners can focus on core operations, leaving the critical yet time-consuming task of bookkeeping in the hands of professionals. It’s a strategic move that offers multiple advantages for businesses of all sizes.

Steps for Outsourcing Bookkeeping Effectively

Define Your Bookkeeping Needs

The first step in outsourcing bookkeeping effectively is understanding your specific bookkeeping needs. What does this mean? It involves getting a handle on your financial accounts, transactions, and monthly expenses to identify exactly what your in-house bookkeeping is currently handling.

Consider the volume and complexity of transactions, financial reporting, tax preparation, payroll processing, and the frequency of financial statements needed, including balance sheets and cash flow statements. Understanding your needs will help you select the right outsourced bookkeeping services to handle the work scope effectively.

Research Outsourcing Options

Once you have a clear picture of your needs, it’s time to explore the various outsourcing options. These options may range from a local or freelance bookkeeper to a bookkeeping firm offering virtual bookkeeping services.

Each of these has its pros and cons. For instance, a local bookkeeper might offer personalized service but need more broad knowledge than a bookkeeping firm could provide. On the other hand, virtual bookkeepers could give access to the latest bookkeeping software and 24/7 availability but might need a more personal touch.

During this research phase, compare the cost, quality, and range of bookkeeping services offered by different providers. Also, consider their reputation, reviews from other business owners, and familiarity with your industry.

Develop a Clear Communication Plan

After choosing an outsourced bookkeeping service, create a clear communication plan. This plan should specify how and when you will receive updates about your financial statements, the frequency of meetings, and the best contact for urgent queries.

A good communication plan will also detail how the outsourcing company will handle your financial information, ensuring transparency and data security. Ensure they can work with your chosen bookkeeping software and deliver accurate financial statements in a format and frequency that suits your business needs.

Implement and Monitor the Outsourcing Process

After defining the roles, it’s time to implement the outsourcing process. This might involve setting up the chosen accounting software, granting necessary permissions for bank accounts and financial data access, and introducing the dedicated bookkeeper to your business processes.

With the outsourcing process in place, monitoring becomes critical. Regularly review the financial reports provided, and assess the quality of the outsourced bookkeeping service. Ensure they meet deadlines, maintain accuracy, and respond to your queries.

In addition, regular checks on your cash flow and balance sheets can help you understand if the bookkeeping service is keeping up with your business’s pace. Also, during the tax filing process, look at how they handle estimated tax payments and manage the accounts payable and receivable management.

Your relationship with your outsourced bookkeepers should be a partnership where both parties continuously strive to improve the processes and maintain the financial health of your business. Always keep the lines of communication open and ensure your service provider is fulfilling their commitment to your business’s success.

Factors to Consider When Outsourcing Bookkeeping

Quality of Services

As you explore how to outsource bookkeeping, it’s vital to prioritize the quality of services on offer. High-quality bookkeeping services can significantly influence financial health, reporting accuracy, and business decision-making. Look for a bookkeeping service that delivers accurate financial statements, timely financial reports, and diligent accounts receivable management.

Availability and Accessibility

The availability and accessibility of your outsourced bookkeeping team are also crucial considerations. Depending on your needs, you might require a bookkeeping firm accessible around the clock, managing different time zones, and responding promptly to your queries. Evaluate whether your potential provider offers a dedicated bookkeeper or a robust bookkeeping team that can meet your business’s unique bookkeeping and accounting needs.

Cost

Outsourcing your bookkeeping often leads to cost savings, but it’s essential to consider the cost-effectiveness of the service. Determine whether the accounting firm offers packages that align with your financial resources and bookkeeping requirements. Balance the cost with the services you’re receiving – investing in a slightly more expensive service could be more beneficial if they offer comprehensive features like cloud-based accounting software, tax preparation assistance, or dedicated account management.

Cultural Compatibility

Cultural compatibility might not be the first factor that comes to mind when considering outsourced bookkeeping services, but it’s a crucial component of a successful partnership. Look for an outsourcing firm that aligns with your company’s values, understands your business environment, and can seamlessly integrate with your existing operations. Whether you’re considering a local bookkeeper or a virtual bookkeeping service, ensuring cultural compatibility can facilitate smoother operations, efficient financial data management, and a healthier bottom line.

Tips for Successful Product Manufacturing

When considering outsourcing bookkeeping, implementing a few key strategies can go a long way in ensuring a successful outsourcing process.

Foster Open and Clear Communication

Effective communication is the cornerstone of any successful outsourcing relationship. When you outsource bookkeeping, it is critical to maintain open communication channels with your chosen bookkeeping firm or virtual bookkeeper. Clear communication about expectations, deliverables, and deadlines is vital in ensuring that the outsourced team understands the specific needs of your business.

Beyond the day-to-day management of your financial accounts, ensure that the outsourcing company provides regular financial reports. These should include balance sheets, cash flow statements, and profit and loss statements, all critical for understanding your business’s financial health.

Also, encourage a culture of feedback. Your dedicated account manager should be comfortable highlighting areas of potential improvement in your financial processes. Similarly, they should be open to feedback about their services, fostering a relationship built on mutual growth and progress.

Maintain a consistent brand voice

While bookkeeping may not directly interact with your customers, maintaining a consistent brand voice across all business operations, including financial ones, is critical. This consistency should extend to the style of your financial reporting and interactions with the outsourced bookkeeping service.

Ensure that any financial communication reflects your business ethos. If your business values transparency, ensure this is reflected in your financial statements. If your business prides itself on its innovation, ensure that your accounting software is the latest and that the use of technology in managing your finances is advanced.

Use Technology to Your Advantage

Technology has become vital in managing business finances in today’s digital age. When you outsource bookkeeping, tap into the advanced technology bookkeeping firms use. Many use high-end bookkeeping or cloud-based accounting software, providing real-time financial data and allowing you to access your financial information anytime, anywhere.

Modern bookkeeping software can significantly streamline the accounting process, automating mundane tasks, reducing human error, and freeing time for more critical business decisions. Moreover, embracing technology in bookkeeping can lead to better financial forecasting, helping you plan for your business’s future more effectively.

Continuously evaluate and improve the outsourcing process

Outsourcing your bookkeeping isn’t a “set-and-forget” strategy. Regular evaluation and improvement of the outsourcing process are crucial to ensuring its success. Regularly check the accuracy of the financial data, the timeliness of the financial reports, and the responsiveness of the outsourcing company to your queries.

Look out for areas of improvement. It could be better software, more frequent communication, or additional tax preparation or payroll processing services. The goal is to ensure that the outsourcing company is not just maintaining your financial records but actively contributing to improving your financial processes.

Your relationship with your outsourcing company should be seen as a partnership where both parties are invested in the other’s success. So, don’t shy away from requesting changes or improvements. After all, your business’s financial health is on the line, and the goal is to ensure it is as strong as possible.

In short, effective communication, maintaining brand voice, leveraging technology, and continuous evaluation and improvement are crucial to successful bookkeeping outsourcing. These strategies ensure that outsourcing adds value to your business, promoting financial efficiency and overall business growth and success.

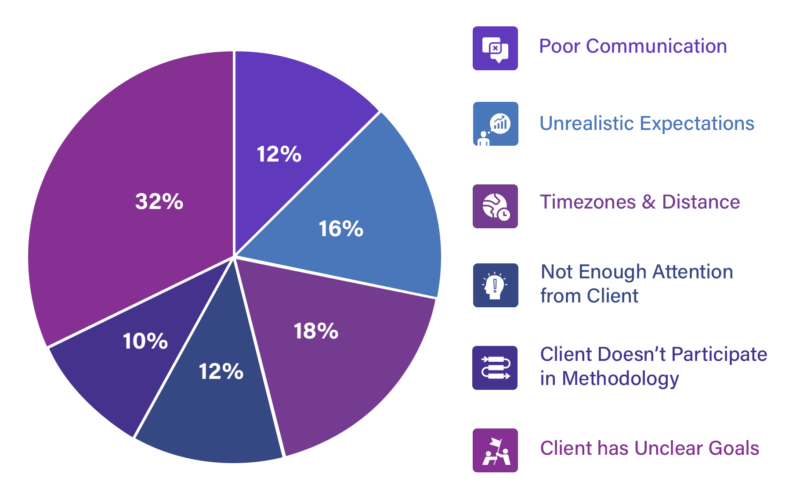

Potential Challenges of Outsourcing and How to Overcome Them

Despite the numerous benefits, outsourcing bookkeeping can pose some challenges. Being aware of these and knowing how to address them can help ensure a smoother process.

Language Barriers

Language barriers could occur when working with virtual bookkeepers from different geographical locations. Overcome this by ensuring your outsourcing company has a team proficient in your language.

Time Differences

With outsourced bookkeeping services, mainly those offshore, time differences can present a challenge. This can be addressed by setting clear expectations regarding delivery times and availability for communication.

Maintaining Control Over the Financial Data

When outsourcing bookkeeping, you may fear losing control over your financial data. Ensure this doesn’t occur by setting up robust policies and guidelines regarding access to and handling financial data with your outsourcing partner. Regular audits can also help maintain control.

Outsourcing your bookkeeping can bring numerous benefits to your business, but the process should be managed carefully. Ensuring effective communication, using technology efficiently, and continuously improving the outsourcing process can help you enjoy the benefits of outsourced bookkeeping without the potential drawbacks. Despite potential challenges like language barriers, time differences, and maintaining control, with careful planning and execution, you can make outsourcing bookkeeping a successful decision for your business.

Whether you’re a small business owner overwhelmed with your bookkeeping or an established firm looking to cut costs, outsourcing bookkeeping can provide an effective solution to manage your financial reporting needs. Remember, the goal is not just to outsource but to outsource successfully.

Leave A Comment

You must be logged in to post a comment.