Businesses dealing with chargeback fees in multiple categories may find automated chargeback process to be a cheaper but less effective solution than hiring software or hiring an outsourced chargeback management. Automated tools may fail to keep up with new fraud types, requiring chargeback professionals in such cases. Companies that lack funds to manage chargebacks in house may need to seek a chargeback management outsourcing company.

Can Fraudulent Chargebacks be Avoided?

Chargeback fraud won’t ever be completely avoidable in the end. The initial reaction is that the chargeback dispute is legitimate, similar to many other types of fraud. Before the banks and card networks can establish if a claim is a potential fraud, they must examine it. Until they make this conclusion, the scam has succeeded. It might take months to settle certain cases.

Types of Chargeback

Criminal Fraud

Occurs when credit cards are stolen or identities are compromised. Fortunately, advances in technology such as EMV chips and criminal fraud detection tools are making it easier to prevent chargebacks and detect these types of chargebacks. By staying informed and vigilant, we can all do our part to prevent disputes, reduce the risk of illegitimate claims, criminal fraud and protect our financial information and sensitive data.

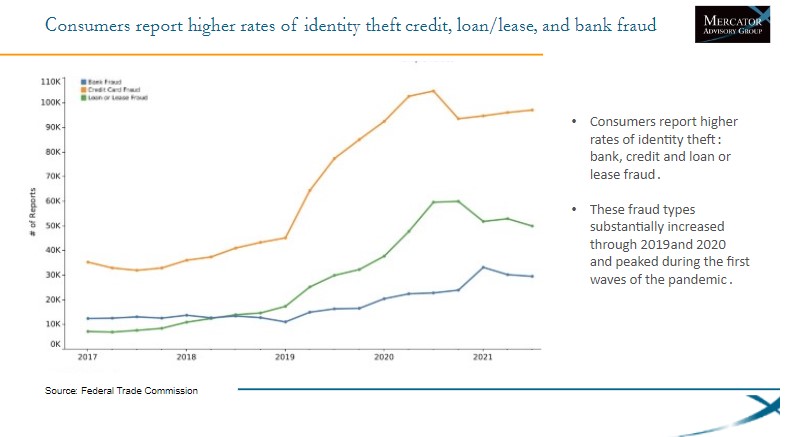

From 2020 to 2021, e-commerce fraud losses increased globally by 18%. The growth in chargeback fraud is being caused by various distinct factors.

The occurrence of fraudulent activity, encompassing various categories such as chargeback fraud, is currently on the rise. This escalation can be attributed, in part, to the amplified number of transactions made through digital or card-based means. As a consequence of the increased number of transactions, there has been a rise in chargeback cases, which subsequently leads to a surge in instances of chargeback fraud.

Friendly Fraud

When it comes to chargebacks, this fraudulent chargeback is possible to happen either intentionally or by accident. This can be due to a range of reasons, such as genuine customer discontent, purchasing errors, or missed unsubscription from a subscription. For example, a customer may return an item out of malice or genuine consumer discontent. Furthermore, purchasing errors can occur due to delivery, payment processors, processing errors, or fulfillment errors. To prevent such fraud and data breaches businesses can establish clear rules for customers on their websites and introduce quality control measures for their payment and sales process.

Purchasing Errors

Many merchants opt for chargeback management outsourcing to minimize the occurrence of errors in the procurement process, which can include errors in delivery, processing, or fulfillment, many merchants can take several measures. Firstly, they can post clear and comprehensive regulations on their websites outlining the procurement process. Additionally, they can implement quality control measures for payment processing to ensure accuracy and efficiency. By doing so, merchants can enhance the overall customer experience and build trust with their clients.

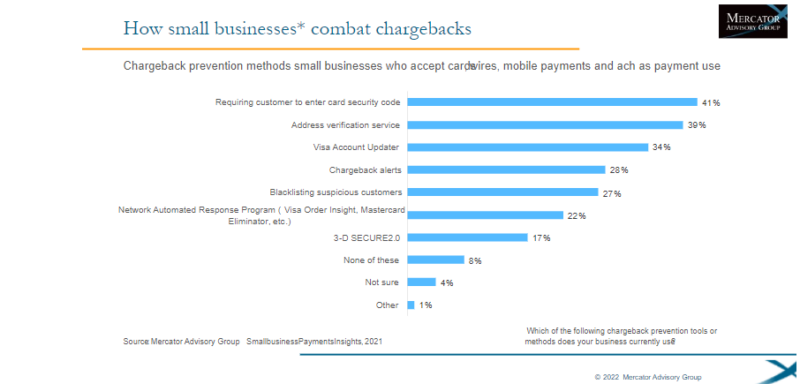

Multiple strategies can be used to combat chargeback fraud. One of the first actions retailers can take to combat chargeback fraud is to know your customers. Merchants can spot early if a customer’s behavior follows known trends by creating an in-depth and detailed profile for them.

Why Opt for Outsourcing Chargeback Management

Chargeback management requires a lot and it can be a difficult and time-consuming procedure for organizations to handle chargeback management internally. As their frequency rises, it’s essential to find practical ways to lessen their effects. One potential game-changer is to outsource chargeback management to qualified specialists who can simplify your operations and offer several advantages.

The outsourcing of chargeback management solutions simplifies customer disputes resolution and offers a more calculated approach. Working with a team of knowledgeable specialists in chargeback and fraud prevention can help reduce chargebacks, recover revenue, improve win rates, lower operational costs, and reduce losses while preserving merchant account relationships and brand reputation. Outsourcing chargeback management allows companies to focus on management, revenue generation, and customer service.

Benefits in Outsourcing Chargeback Management Services

Access to a Skilful Team

Partnering with a chargeback management outsourcing provider can generate income without hiring or educating staff, or investing in technology in house management to detect, aid in managing chargebacks, and any chargeback disputes.

Saving Costs and Flexibility

If you’re looking to reduce your overhead expenses and enhance your chargeback management capabilities, consider partnering with a specialized service provider. By outsourcing chargeback management solution to an expert team, you can benefit from their knowledge, experience, and cutting-edge technology in chargeback management strategy to streamline processes and minimize the risk of lost revenue. Plus, you can free up your valuable time and resources to focus on other important aspects of your business.

Accentuate Company Strength

Managing chargebacks can be time-consuming and resource-intensive, which can take away from your main business operations. By outsourcing this activity, you can free up your staff to focus on strategic objectives like improving client experiences and increasing revenue growth. This allows you to direct your resources where they are most needed, ultimately improving your overall operational effectiveness

Infrastructure and Integration

Minimizing chargebacks and maximizing win rates is crucial to your success. That’s why it’s essential to have a chargeback management companies that connects with a fraud-management service. By doing so, you can proactively deal with hostile fraud and acquire the necessary proof to stop friendly fraud and customer service chargebacks. The chargeback management firm will use vast amounts of data and system resources to pinpoint the specific types of disputes that your business has the highest chance of winning, reducing the overall number of chargebacks you receive. By reviewing all incoming chargebacks, your service provider can also gain insight into the most frequent justifications for chargebacks and suggest steps to minimize them.

Revenue Recovery

As a business owner, it’s important to keep an eye on your ratios and revenues. Don’t forget to factor in chargeback fees, fulfillment activities, and missing goods when calculating your profit margin. These expenses can add up quickly and eat away at your bottom line. To avoid them, consider implementing an account verification feature and outsourcing your chargeback management to a provider with historical standards to compare your business to. This will allow you to successfully challenge more chargebacks and save time and money in the long run. With an automated workflow, your provider can quickly discover, organize, and respond to chargebacks, ensuring that you never miss a beat.

Chargeback management software: what is it?

Chargeback management can only be effectively managed manually for some large retailers. By recording, reporting, analyzing chargeback data, and keeping internal records, chargeback management software aids retailers in automating the process.

Software for chargeback management is frequently in-house management or self-managed, outsourced to a business, or a hybrid of the two. For many companies with a tight budget that desire total control over the chargeback procedure, in-house solutions might be an intelligent option.

But there are drawbacks. When you rely only on internal management, you need someone to ask for advice from. However, building an internal system to manage these chargebacks can be expensive and eat up internal resources and personnel that might be better used on projects that can increase income and increase revenue.

How to Outsource Chargeback Management Efficiently

Review your Chargeback Requirements

It would be wise to thoroughly evaluate your chargeback management strategy. Take note of any chargeback issues that arise, as well as the number of chargebacks, resources utilized, and any complications that may have been encountered during the handling of complaints and disputes. By doing so, you can gain a better understanding of your company’s specific needs and whether outsourcing may be the best solution.

Define the Avenues of Communication

To enable continued cooperation, create efficient communication routes. Regular gatherings, email updates, or specific project management tools may be part of this. Thanks to clear communication, you will continually be updated on the status of chargeback cases and any new trends.

Compliance and Security

When it comes to chargeback management, it’s crucial to put compliance and security measures in place. Your outsourcing partner chargeback management approach must follow strict data protection laws and keep up with reliable security practices. To ensure the privacy and security of your sensitive information, make sure to look for certifications such as PCI DSS. This way, you can have peace of mind knowing your data is being handled with the utmost care and protection.

Effective Line of Communication

To enable continued cooperation, create efficient communication routes. Regular gatherings, email updates, or specific project management tools may be part of this. Thanks to clear communication, you will continually be updated on the status of chargeback processes and any new trends.

Knowledge Exchange

It’s crucial to establish a collaborative relationship with your outsourcing provider to ensure a seamless exchange of information regarding your company’s products or services, as well as your chargeback procedures. Providing comprehensive documentation and training materials can assist in facilitating a smooth knowledge transfer.

Network Integration

Incorporate your existing systems seamlessly with the platform utilized by the external partner to enable a seamless flow of data and prompt access to chargeback data. This linkage facilitates efficient collaboration and ensures that both parties have access to the most up-to-date information.

Reputation and Background

When selecting an outsourced company to assist with chargeback management, it is crucial to consider their reputation and background. It is highly recommended that you thoroughly examine their previous track record, customer endorsements, and case studies to gain insight into their level of expertise and understanding of the market. A trustworthy partner with substantial chargeback management experience can provide invaluable best practices and guidance to ensure optimal outcomes.

SLA (Service Level Agreement)

When working alongside an outsourced chargeback management, it is crucial to establish clear expectations and deliverables through well-defined service-level agreements (SLAs). Such agreements should specify the entire process of reporting intervals, recovered revenue, communication routes, and turnaround times for filing and resolving disputes. By establishing these SLAs, partners can establish a framework for responsibility and ensure ongoing transparency throughout the duration of their partnership.

Common Misconceptions about Chargeback Management

Lost of Control

Some companies worry that by outsourcing chargeback management, they may lose control over the procedure. But trustworthy outsourcing partners collaborate with you, offering frequent updates, open reporting, and customization choices to match their services to your particular needs.

This makes sure that you maintain oversight and command over the procedure while gaining the assistance of experts.

Struggle in Communication

In order to ensure a timely and accurate resolution of chargebacks, it is crucial to establish effective communication channels. However, there are various obstacles that may impede this process, such as language barriers, differences in time zones, or insufficient communication with outsourced partners. These obstacles can result in delays and errors, further complicating the chargeback process. It is essential to address and overcome these communication challenges in order to facilitate a smooth and efficient resolution of chargebacks.

Data security

One of the major hazards faced by businesses in terms of data security is the risk of unauthorized access to sensitive information. This can result from various factors, including malicious attacks, human error, or technical vulnerabilities. The impact of a data breach can be severe, ranging from financial losses, reputational damage, to legal liabilities. To mitigate these hazards, businesses must adopt a comprehensive approach to data security. This involves implementing a range of measures to protect their sensitive client data, including encryption, access restrictions, and compliance with industry standards. It is also essential to establish strict service-level agreements (SLAs) with outsourcing partners to ensure that they adhere to best practices in data security. Outsourcing partners play a critical role in data security, and businesses must choose their partners carefully. Thorough screening of prospective partners is essential to reduce risks, and companies must ensure that their partners have robust security systems in place to protect their data.

Lack of Personalized Customer Service

One of the main concerns regarding outsourcing is the potential lack of personalized customer service. This can lead to a generic approach to strategy and a need for individualized client attention. Fortunately, reputable chargeback management companies recognize the importance of establishing and maintaining strong client relationships. By doing so, they can provide tailored support that addresses each client’s unique needs and concerns. This personalized approach not only enhances the client experience but also contributes to greater overall satisfaction and retention.

Thankfully, when it comes to resolving disputes, there are convenient and effective outsourcing solutions for chargeback management. These solutions can provide a more strategic approach, thanks to a team of experienced chargeback and fraud-prevention specialists. By partnering with a chargeback management outsourcing company, you can expect a reduction in the number of chargebacks received, while improving your win rates, decreasing operational expenses, mitigating losses, and maintaining strong relationships with your merchants. Most importantly, your brand image will remain protected. Outsourcing your chargeback management needs is a smart way to free up your valuable time and resources, allowing you to focus on growing your business, generating revenue, and delivering exceptional customer service.

Leave A Comment

You must be logged in to post a comment.