The Accounts Payable (AP) department is an important function within a business that tracks vendor invoices and ensures that payments are properly approved and processed. As your business grows, keeping your finances in order becomes more critical. Businesses frequently do not have enough workforce to handle all of their accounts payable (AP) paperwork.

Determining whether outsourcing the accounts payable process is economical can be challenging. The lack of direction can cause organizations to either not outsource when they should or to outsource unnecessarily, both of which can impact them negatively. In this article, we will discuss the costs and potential benefits of outsourcing accounts payable to help your business make an informed decision that is aligned with its goals and financial objectives.

Why Should You Outsource Accounts Payable?

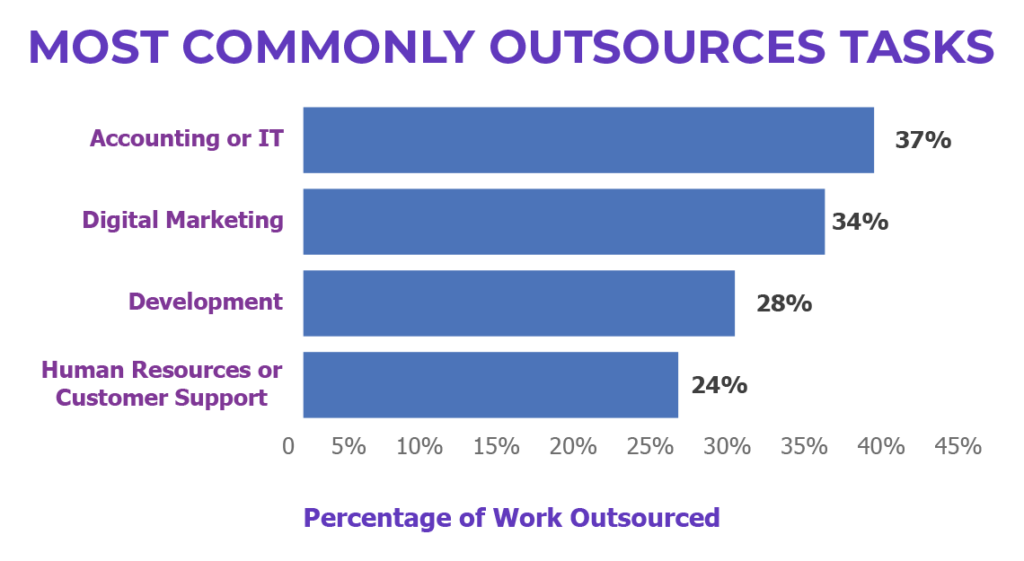

AP departments may encounter a number of typical challenges such as data errors, delayed approvals, matching errors, and late payments. To overcome these difficulties, AP outsourcing may be a practical solution for many businesses. Here are some of the other reasons why your business should consider outsourcing accounts payable.

Cost-Savings

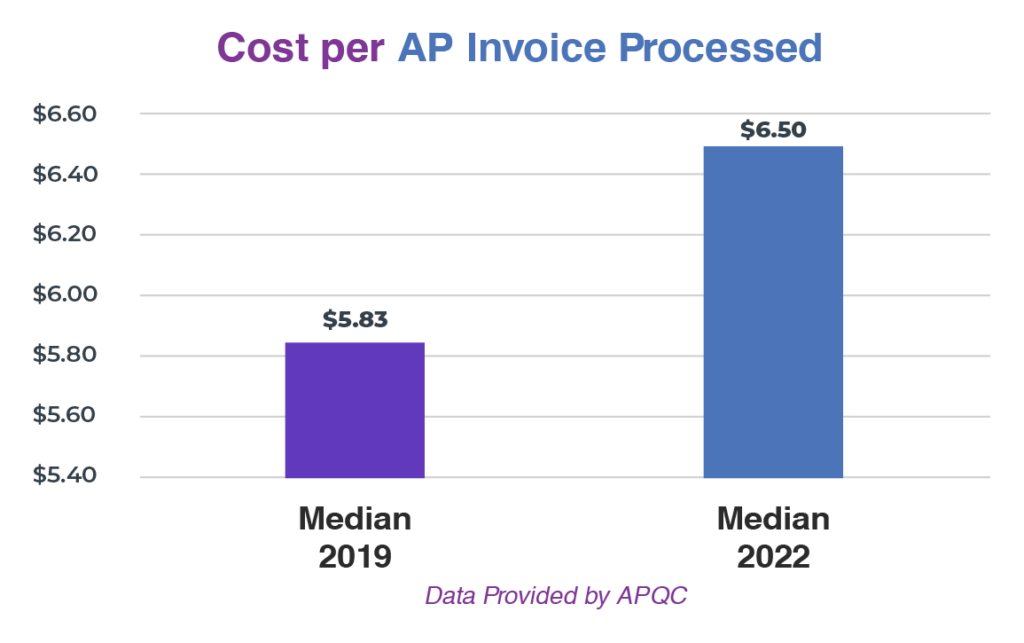

Outsourcing accounts payable is a cost-effective option because it gets rid of the need to hire and train employees, spend on infrastructure and technology, and manage the process internally. This may lead to reduced labor expenses, increased productivity, and cheaper processing costs.

Access to Experienced Professionals

Businesses can have access to professionals who are knowledgeable about best practices, compliance requirements, and industry standards through outsourcing. By doing this, the risks are reduced and the accounts payable process is streamlined.

Focus on Core Business Activities

If you leave the AP functions to a third-party service provider, your internal staff can focus on your business’s core competencies such as product development, decision-making improvement, and analysis. This can lead to improved productivity and competitiveness.

Improved Efficiency

Manual data entry errors are common in manual accounts payable processes. AP outsourcing companies are industry experts with streamlined processes and cutting-edge tools that help them improve the efficiency and accuracy of the accounts payable process. As a result, processing times are shortened, errors are reduced, and supplier relationships are strengthened.

What Impacts the Cost of Outsourcing Accounts Payable?

Volume of Invoices

Typically, outsourcing companies charge by the number of invoices processed, which means that the more invoices a company has, the more expensive it will be. Processing a high volume of invoices may require additional staff to handle the workload, and more time to process, which may lead to a longer turnaround time for payments.

Complexity of Invoices

The number of line items in an invoice and multiple currencies may affect the overall cost of outsourcing accounts payable. Complex invoices normally require longer processing time, resulting in higher processing fees.

Additionally, invoices that need extra approvals or special handlings, such as expedited payments or dispute resolution, may also increase the cost of outsourcing. The outsourcing company may need to spend more time and effort providing these extra services, which results in higher fees.

Level of Service Required

Outsourcing providers may offer a range of services, from basic processing to more customized services.

Businesses that require a personalized service or customized workflows may be charged more compared to those that require a standard service level. This is because customized services require more time and attention from the outsourcing provider.

The level of service needed by the business will impact the cost of outsourcing accounts payable.

Geographic Location

Pricing may be more competitive from providers in lower-cost areas compared to those in higher-cost areas. This is because the cost of living and labor rates range greatly between countries, which causes variations in outsourcing prices.

Technology Infrastructure

Accounts payable service providers with more advanced technology such as automated invoice processing, digital workflows, and online portals, may be able to deliver more efficient and cost-effective services than those with less advanced technology infrastructure.

Digital workflows can speed up the invoice approval process, cutting down the time required for manual review and approval, and lowering the processing costs.

Investing and maintaining in advanced technology, however, may lead to higher outsourcing fees.

Contract Terms

Compared to short-term contracts, a contract with a longer period may offer more competitive pricing because the outsourcing partners can plan their resources over a longer period. The payment terms and service levels in the outsourcing contract can also affect the accounts payable outsourcing cost.

Outsourcing Accounts Payable vs. In-house Accounts Payable – Direct Comparison

Initial Setup Costs

If you decide to outsource your AP processes, the initial setup costs will be handled by the outsourcing company. They have already made investments in technology, software, and infrastructure to process accounts payable and these expenses will be factored into their charges.

On the other hand, if you choose to keep your AP processes in-house, you need to invest in the technology infrastructures needed to support your accounts payable functions. This includes purchasing accounting software, setting up an office space, and hiring staff.

Due to the outsourcing company’s prior infrastructure investment, outsourcing accounts payable services typically results in lower initial setup costs.

Ongoing Expenses

When outsourcing AP, the ongoing expenses will include the outsourcing company’s fees, which are normally calculated on a per-transaction or monthly basis. This can vary based on the volume of invoices, their complexity, and the level of customization required.

Keeping an in-house AP team, however, involves ongoing expenses such as salaries and benefits of the AP staff, maintenance of the accounting tools, and overhead costs like utilities and office supplies.

Depending on the volume of invoices that a company needs to process and its business goals, managing the AP processes internally can be both a good option and not. For businesses with a high volume of invoices, in-house AP management can be a better option because the ongoing expenses associated with outsourcing have a tendency to accumulate over time. On the other hand, outsourcing can also be a good choice if the business wants to focus on its core business activities.

Total Cost of Ownership

The direct costs of outsourcing AP include the fees charged by the outsourcing company. The direct costs of managing AP in-house, on the other hand, include the salaries and benefits of the AP staff, technology infrastructure costs, and overhead expenses.

The indirect costs of outsourcing AP can include data security risks, lack of control over AP processes, communication issues, and contract management costs. In contrast, the indirect costs of keeping AP in-house include staff training and turnover, potential human error in invoice processing, software and hardware updates, compliance and audit costs, and process improvement costs.

It is important to consider both the direct and indirect costs associated with accounts payable outsourcing services and managing them internally.

Choosing the Right Accounts Payable Outsourcing Provider

Reputation and Experience

Look for a service provider that has a good reputation and experience in accounts payable outsourcing. A reputable and experienced partner can give you assurance that your financial processes are safe.

Quality of Service

Outsourcing AP services with a provider that offers a high-quality accounts payable solution is essential for the accurate and timely processing of transactions, compliance with regulatory requirements, and flexibility in adapting to your organization’s changing needs.

Integration with existing systems

Choose an outsourcing company that is knowledgeable about the integration of different systems. Integration with your existing Enterprise Resource Planning (ERP) or accounting system eliminates manual processes, thus, reducing the risk of errors and improving the efficiency of your accounts payable processes. It also ensures consistency across different departments within your organization.

Technology

Technology plays an important role in your AP tasks as it streamlines processes, reduces manual errors, and accelerates payment processing. Choose a company that uses cutting-edge technologies for AP processing, because this will guarantee that your transactions are securely and accurately processed.

Security

Your AP partner will handle sensitive financial information so it is very crucial to find a company with strong security measures in place to protect your sensitive financial data. This includes data encryption, restricting access, and regular security audits. Strong security measures will take care of any potential legal or reputational repercussions to your business.

Customer Support

A service provider with good customer service will build a strong relationship with your organization. This includes responsiveness, transparency, proactive communication about issues or trends, and a willingness to work collaboratively to improve processes.

Outsourcing accounts payable can be a cost-effective solution for businesses looking to improve their efficiency and focus on their core business activities. While outsourcing AP services can offer many benefits, several factors may affect the overall cost of outsourcing such as the volume and complexity of invoices, the level of service required, the geographic location of the outsourcing partner, the technology infrastructure, and the contract terms.

When making a decision whether to outsource your accounts payable processes or keep them in-house, it is important to consider the initial costs, outgoing expenses, and total cost of ownership for both options. Several factors to consider in choosing an outsourcing partner are the company’s reputation and experience, the quality of its service, knowledge in integration with your existing systems, the technologies they use, and good customer service.

Businesses can optimize their financial operations and gain long-term operational efficiencies in their accounting department by carefully weighing the costs and advantages of outsourcing accounts payable and choosing a trustworthy and experienced outsourcing partner.

Leave A Comment

You must be logged in to post a comment.