In today’s increasingly complex and competitive business environment, financial service companies face various challenges in providing efficient and cost-effective services to their clients. One key issue they face is balancing the demands of staying competitive, ensuring regulatory compliance, and managing operational costs.

Business Process Outsourcing (BPO) offers several effective ways to address these challenges. This article will discuss ten reasons financial service companies should use a BPO. From cost savings to risk mitigation and global expansion, BPO provides various benefits that can fuel long-term growth and success in the fast-paced finance industry.

1. 24/7 Support Advantage

Customer service used to be a “business-hours only” concern, with companies assisting mostly on weekdays. Due to the global scope of their business operations and the vital nature of financial transactions, 24-hour support is important for financial service companies. Financial service customers frequently require instant assistance or have time-sensitive questions that cannot be answered during regular business hours. Whether resolving a fraudulent transaction, managing account-related difficulties, or delivering real-time market updates, round-the-clock help ensures that customers receive quick and efficient service, regardless of their geographic location or time. This service indicates a dedication to customer satisfaction, fosters trust, and improves the customer experience, resulting in improved loyalty and retention.

Furthermore, 24/7 support allows quick response and resolution in emergency scenarios, such as system outages or financial disruptions, limiting possible losses and reputational damage.

2. Scalability

Customer service is essential for any organization. However, maintaining stable employee numbers can be difficult when demand fluctuates. Adapting to shifting needs is critical for businesses to maximize customer satisfaction and remain competitive, whether due to seasonal swings or market trends.

Customer service demands in financial service companies often fluctuate. The surge of inquiries and requests at peak periods, such as tax season or product launches, can overwhelm internal customer service teams. Many businesses struggle with the expense and challenges of hiring and establishing a full-time internal team. To address this, financial companies are using BPOs to scale their service capabilities as needed easily.

Outsourcing provides flexibility to scale up or down, providing consistent customer service. BPO companies are equipped to handle high call volumes, provide extended support hours, and adapt to changing customer needs, allowing financial companies to provide outstanding service without sacrificing quality or efficiency.

3. Reduces Operational Costs

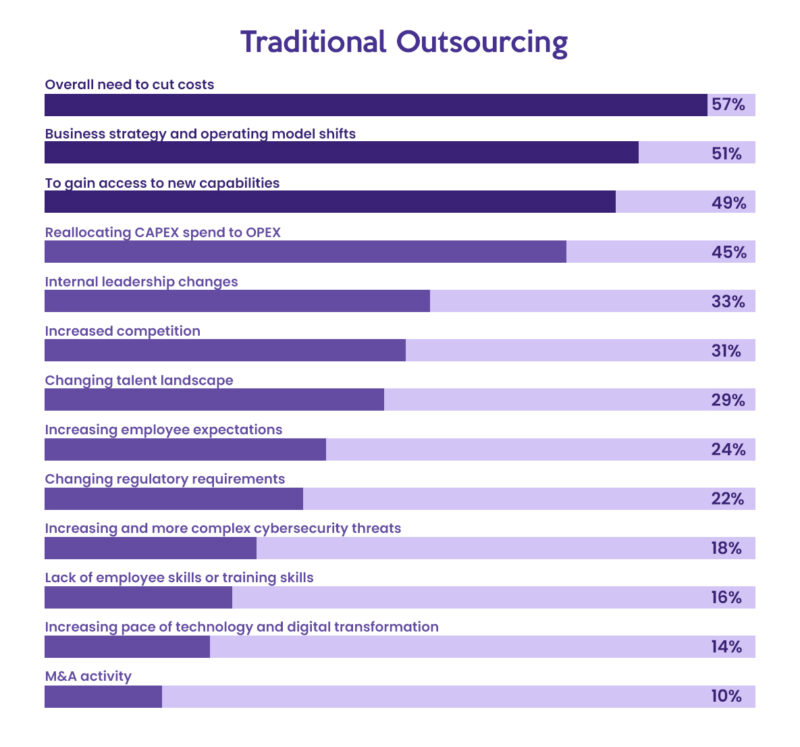

One of the key areas where outsourcing can result in considerable cost reduction is staffing and labor expenditures. In a report released by Deloitte, when asked about the primary drivers behind their growing use of traditional outsourcing, 57% of executives said that it is the overall need to cut costs.

Hiring and training in-house personnel may be a time-consuming and costly process. Financial service companies can save recruitment, training, and payroll costs by outsourcing customer support, accounts payable, or data entry tasks. Outsourcing also gives companies access to a global talent pool, allowing them to hire competent finance professionals in lower-cost regions, further reducing costs.

The financial services industry relies heavily on innovative technology and infrastructure to operate efficiently and securely. However, such systems can be costly to maintain and upgrade. Outsourcing allows financial service providers to capitalize on the investments made by BPOs in cutting-edge technological platforms. By outsourcing, companies can save significant expenses associated with infrastructure upgrades, software licenses, and maintenance. This cost-sharing strategy enables businesses to shift financial resources to core business activities while benefiting from the BPO’s expertise and technology.

4. Risk Mitigation

Risk management is very significant within the field of finance, and it has become increasingly essential for all players in the financial services ecosystem over time. The financial services industry operates in a complex regulatory environment, and failure to comply can result in severe penalties and reputational damage. One of the primary benefits of partnering with a BPO company is the opportunity to tap into outside expertise. BPO providers typically have had hundreds of interactions with many organizations in different industries. This breadth of experience they gained from implementing solutions in various settings can help identify potential risks your company may not know and recommend new and effective ways to protect your company’s assets and systems.

BPOs specializing in compliance-related services, such as anti-money laundering (AML) checks, Know Your Customer (KYC) verifications, or fraud detection, have the skills, knowledge, and sophisticated systems to assure regulatory compliance. Outsourcing these services can help companies decrease compliance risks and expenses.

5. Access to Better Processes and Tools

Aside from cost savings and scalability, outsourcing provides a huge advantage in accessing better business processes. BPO companies specialize in process optimization and bottleneck elimination. They have a solid understanding of the financial industry’s unique issues and complexities. BPOs have refined their financial processes over years of experience and exposure to numerous financial service functions. They systematically handle projects, leveraging their experience and understanding of industry benchmarks.

Outsourcing to BPO providers typically offers access to innovative technologies and automation solutions. BPOs invest in cutting-edge infrastructure, software, and automation tools to provide high-quality services. Financial service companies can leverage these advancements without significant capital investments or ongoing maintenance costs. Partnering with a BPO enables companies to optimize their financial operations and implement efficient processes honed through continuous improvement efforts, resulting in higher accuracy and improved overall performance.

6. Faster Time-to-Market

Financial service companies can benefit from the expertise of BPO providers who understand the industry’s complexities and regulatory requirements. Their knowledge aids in streamlining procedures, minimizing delays, and navigating potential barriers, resulting in faster project execution and time to market.

BPOs can quickly allocate resources and adjust staffing to fit project demands, helping businesses to meet aggressive timelines and launch initiatives faster. Whether it is growing customer support or enhancing compliance skills, BPOs provide scalability that can drastically reduce time to market. Companies can leverage the expertise and capacity of BPO providers without going through lengthy hiring processes or investing in additional internal resources.

7. Enhanced Data Security

Due to data security and confidentiality concerns, many financial service companies are skeptical about outsourcing some of their business functions. Whether partnering with an external service provider is a good or bad decision for a finance company depends on the BPO company, their engagement type, and both parties’ willingness to collaborate on ensuring data security and integrity.

BPOs specializing in the financial services sector have security expertise. They have well knowledgeable about the industry’s security standards and regulatory frameworks, such as the General Data Protection Regulation (GDPR) and Payment Card Industry Data Security Standard (PCI DSS). BPO companies invest in modern technologies, strong security measures, and security-focused employee training to ensure the implementation of industry-leading security policies, risk mitigation strategies, and proactive threat detection measures, leading to strengthened data security.

8. Agility and Innovation

Traditionally, outsourcing has been about cost reduction. Today, motives have changed due to social, mobile, analytic, and cloud technological advances. While cost savings are still expected, leaders are also now seeking other business outcomes like agility and innovation. Many financial service companies are partnering with BPOs to help them innovate and reap the benefits of financial outperformance.

Due to the staffing flexibility that most BPO companies offer, businesses can gain a lot, whether it’s a short-term project or a long one. By partnering with a BPO provider, businesses can give their internal human resources team more time to work on tasks with a greater value for the company rather than overloading them with recruitment work. This flexibility promotes agility by allowing companies to allocate resources as needed.

Additionally, BPOs provide access to advanced technologies and expertise that could otherwise be difficult or costly to acquire internally. BPO providers invest in initiatives focusing on innovation, enabling financial services organizations to leverage the latest advancements and foster a culture of innovation.

9. Data Analytics and Insights

The financial industry has always been heavily data-driven, maintaining large amounts of customer data. With the increasing volume and complexity of financial data, financial institutions must embrace data analytics to remain competitive.

Here are some remarkable advantages of using data analytics:

Data analytics helps companies identify, assess, and mitigate various risks, such as credit, market, and fraud.

It gives meaningful insights, allowing financial service companies to make data-driven decisions to improve customer experience and increase profitability.

Data analytics can automate manual processes, identify bottlenecks, and optimize resource allocation.

It enables real-time performance monitoring to identify performance gaps and make timely adjustments to improve efficiency.

By analyzing customer data, companies can deliver customized financial solutions, improving customer satisfaction.

BPO providers specializing in finance frequently have strong knowledge of data analytics. They work with competent data analysts and data scientists who are experts in statistical modeling, predictive analytics, and data visualization approaches. BPOs can assist companies in effectively collecting, analyzing, and interpreting enormous amounts of data, uncovering significant insights that can drive strategic decision-making.

10. Global Expansion

Outsourcing financial services can help organizations with their global expansion initiatives. When entering new international markets, businesses may encounter complex regulatory frameworks, unfamiliar tax systems, and unique compliance requirements. Companies can leverage the expertise of BPOs who possess knowledge of local laws and regulations. These service providers can navigate the complexities of international finance, ensure compliance, and reduce risks. Furthermore, they can help businesses adapt to various accounting standards and reporting needs, maintaining transparency and consistency across various markets. Overall, outsourcing finance and accounting services offer businesses the support and skills they need to overcome the challenges of global expansion, allowing them to focus on their core business functions and achieve sustainable growth in new markets.

Companies in the financial service industry should embrace BPO as a strategic way to improve their financial management capabilities. BPOs offer numerous advantages and benefits, such as reduced operational costs, mitigated risks, access to better processes and tools, enhanced data security measures, and enhanced operational efficiency. Integrating BPO into financial service strategies can empower organizations to achieve sustainable growth, maximize profitability, and provide better customer service.

Leave A Comment

You must be logged in to post a comment.