Effective debt collection is essential to maintain the financial stability of a business. While some companies opt to collect debts through their in-house collections team, many will refer to a business process outsourcing (BPO) company that attempts to recover the debt with a predetermined charge. These agencies help the business and significantly boost the US economy by recovering tens of billions of dollars in delinquent debts each year that could otherwise go uncollected.

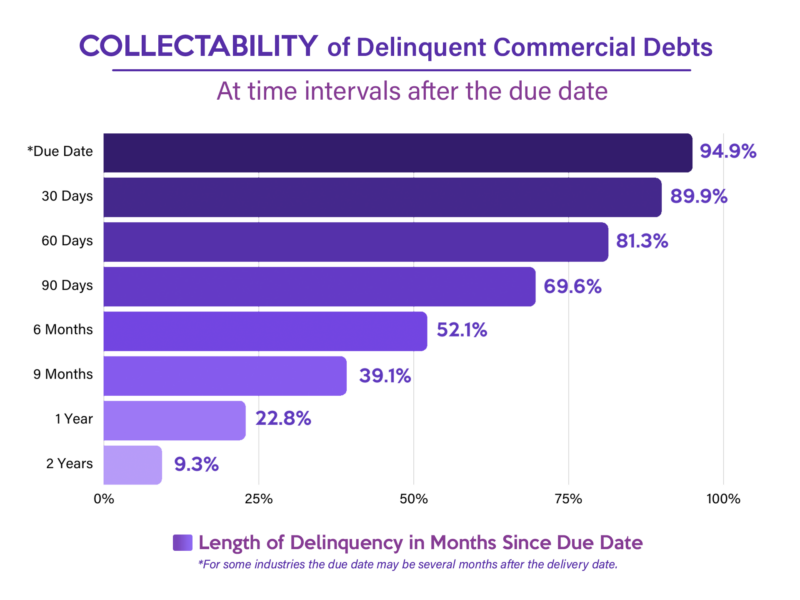

The Commercial Collection Agency Association (CCAA) of the Commercial Law League of America agrees that the likelihood of collecting on a delinquent account decreases significantly as time passes. According to the data, when a debt is 30 days overdue, it has already lost more than 10% of its initial value in terms of recoverability. By 90 days, the likelihood of collecting is only 74%.

Before we look into the benefits of outsourcing collections, here are common reasons why collecting old debts can be particularly challenging for businesses:

Statute of Limitations on Debt

The statute of limitations sets a time by which a creditor can legally pursue the collection of a debt. After this period has passed, the debtor may have legal grounds to contest or resist the collection attempt. This varies depending on the type of debt and jurisdiction.

Lack of Documentation

Important records about the debt may become missing over time. This makes it more challenging for the creditor to prove the existence of the debt, the terms of the agreement, or the amount due.

Lack of Contact Information

As debts age, the debtor may change their contact information and becomes difficult to locate. This makes the collection efforts more difficult. Without updated contact details, creditors may find contacting debtors and discussing settlements challenging.

Reluctance of Debtors

Some debtors may purposefully delay paying their debts or decline to acknowledge them. They may change their address, ignore calls or correspondence, or take other actions to protect their assets from creditors. Their unwillingness to comply can prolong the collection process.

While debt collection presents several issues for businesses, working with a BPO company can be a transformative option to handle these challenges. In the following sections, we will delve into the reasons why a BPO for collections can transform a business.

1. Lower delinquency rates

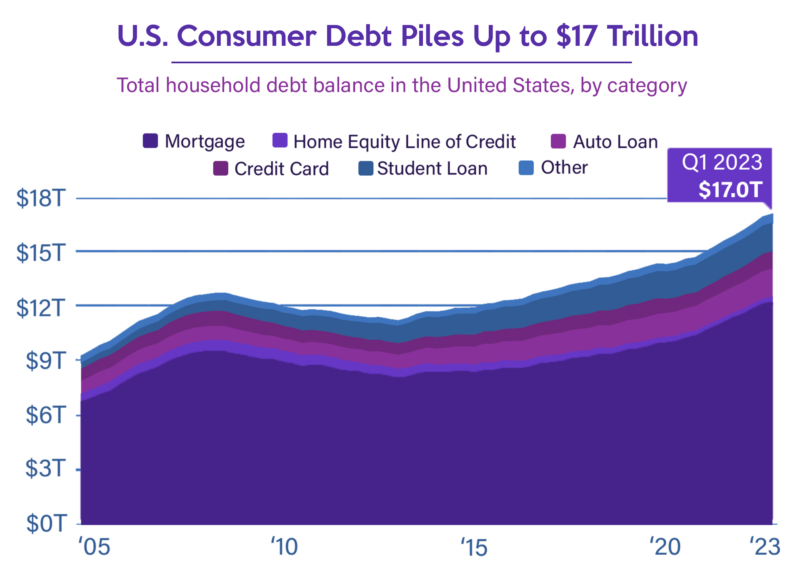

In the first quarter of 2023, 2.23 percent of all consumer loans in the United States were delinquent. The delinquency rate of this type of credit decreased after the first quarter of 2020 when it reached 2.43 percent, but it has been rising again since 2021.

Partnering with a BPI provider to recover past-due funds on your behalf can help decrease delinquency rates. They are experts in the best practices for collecting funds and can handle situations that may arise professionally and courteously.

Collection outsourcing companies are trained to reach out to delinquent customers, negotiate payment arrangements, and implement strategies to recover outstanding payments. They can leverage analytics tools to assess customer behavior and identify patterns indicating a higher delinquency chance. Moreover, BPOs can assist financial institutions and lending firms by offering credit scoring and underwriting services. This includes evaluating a client’s creditworthiness, estimating the risk of a loan, and establishing suitable terms and conditions. All of these services help in minimizing delinquency rates.

2. Reduced collection time

As opposed to having a small number of internal debt collectors using only a portion of their time collecting delinquent accounts, outsourcing to a BPO provider gives you an external staff that will dedicate 100% of their time to collecting. The time spent managing a past-due account is reduced due to the increased focus and time put into the collections process.

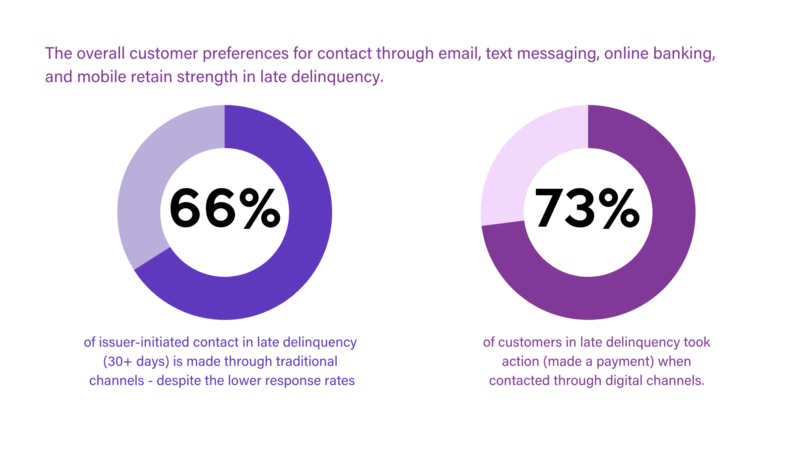

BPO providers can also use several communication channels to reach out to customers and speed up collection. They can communicate with debtors through a combination of email, phone calls, text messaging, and automated voice messages. By utilizing multiple channels, BPOs increase the likelihood of reaching customers promptly and receiving timely responses. Additionally, collection software solutions help automate tasks, such as tracking payment schedules, generating collection letters, and managing customer interactions. This assists streamline processes and reduce manual efforts.

It is important to note that the effectiveness of collection agencies in reducing the collection time is also affected by the complexity of the debt and the legal and regulatory framework within which collections are conducted.

3. Boosts productivity and revenue

Professionals from collection BPO companies are experts with specialized skills and experience in collections. They are trained in negotiation strategies, dispute resolution, and effective communication with debtors. Their expertise enables them to use proven techniques and best practices to increase collection rates.

BPOs collaborate closely with businesses to develop collection strategies tailored to their specific needs. They analyze data, segment the debtor base, and develop targeted collection techniques. By customizing strategies, collection agencies can enhance their operations, boost debtor engagement and increase the possibility of successful payments.

4. Increased collection rate

Finding the time to contact customers about past-due payments can be difficult. Working in collections takes up time that could be spent generating new revenue for the business. Outsourcing collection services free employee time for activities that improve customer experience and customer satisfaction. Companies can focus more time, resources, and effort on achieving strategic objectives like enhancing customer service, growing the brand, increasing market accessibility, and creating new revenue opportunities through cross-selling or introducing new products or services.

5. Cost-effectiveness

Cost reduction is one of the significant benefits of outsourcing debt collections. Companies can save money on salaries, employee benefits, and office space that would otherwise be spent on recruiting, training, and keeping an in-house collections team. The salary range for a debt collector in the United States falls between $40,519 and $47,516. Companies can lower this cost by outsourcing BPO services.

6. Legal compliance

Companies of all sizes, from startups to mature businesses, struggle to keep up with their Collections Receivables. They must comply with the applicable federal, state, and local laws about collections, and failure to do so could result in penalties.

The rules and regulations governing collections can be overwhelming. Collection agencies are aware of industry regulations, such as the Fair Debt Collection Practices Act (FDCPA), and take steps to ensure they comply with them. This safeguards companies from possible legal action and reputational damage.

7. Increased profit Margins

There are several reasons why outsourcing debt collection could help a business increase its profit margins. One benefit is that BPO companies can be up to 70% less expensive than hiring an in-house team. Experience and focus are additional significant reasons. Debt collection agencies are dedicated to debt collection and recovery; therefore, they will take the necessary procedures to ensure that payments are made on schedule. By having a workforce focused on unpaid invoices, your business’s delinquency rates would be lower.

8. Access to the latest collection technology

Technology is also another challenge for collectors. It takes more than a quick email to send and manage bills. For things to operate well and collect payments fast, numerous current technology and best practices must be used.

Collection agencies invest in technology and resources, such as predictive dialers, automatic call distributors, and loan recovery software, to promote efficiency throughout the collection process. These technologies may be too costly and unjustifiable to be purchased and maintained internally. Debt collectors are given capabilities and capacities well beyond what most internal collections teams can afford.

Here are some ways IT resources improve collection efficiency and effectiveness:

- Business rules and workflows

- Fraud detection

- Dialer workflows and communications channels

- Integrated bankruptcy monitoring service

These systems gather the information used to evaluate the efficiency of the entire collection process. Regularly analyzing these metrics helps improve skip-tracing techniques, identify the best contact strategy based on borrower patterns, and fine-tune workflows to meet better changing collection needs.

Historically, the BPO industry has been at the front line of the collections industry with its commitment to improve business operations and processes. For a business owner, the transformative impact of working with a BPO cannot be overstarted. Partnering with a BPO for collections can revolutionize a company’s debt recovery processes and drive financial success. By using the expertise and technology resources offered by BPO agencies, business leaders can overcome the challenges that hinder the effective debt recovery. Outsourcing collection services can save costs, improve efficiency, enhance recovery rates, and boost productivity and revenue. Embracing a partnership with a BPO company allows businesses to focus on their core competencies while benefiting from the expertise and proven methodologies offered by the BPO.

Leave A Comment

You must be logged in to post a comment.