Company executives and leaders have taken on a number of tasks due to the complexity of conducting business and keeping a company with strong competitive standards. Non-core processes such as payroll, tax compliance, and accounting are examples of these.

According to Deloitte’s 2022 Global Outsourcing Survey, 52% of executives said that they use external service providers for their business functions. Among the top 5 of these functions are Tax and Finance.

A few noteworthy stats:

- 83% of small businesses will maintain or increase their spending on outsourced business services in 2023 (Source: Clutch)

- Over half of the small businesses (52%) regularly use services from a professional firm or agency. (Source: Clutch)

- 58.3% of businesses outsource to gain access to quality resources and services. (Source: GoodFirms)

- According to the Accounting Today 2022 The Year Ahead Survey, 51% of firms said their biggest challenge is keeping up with regulatory change.

Business process outsourcing in finance and accounting (F&A) offers businesses a strategic way to streamline their financial operations and increase efficiency. In this article, we will explore the five pillars of outsourcing finance and accounting and how these pillars play a significant role in driving business success and growth.

Pillar 1: Cost Efficiency

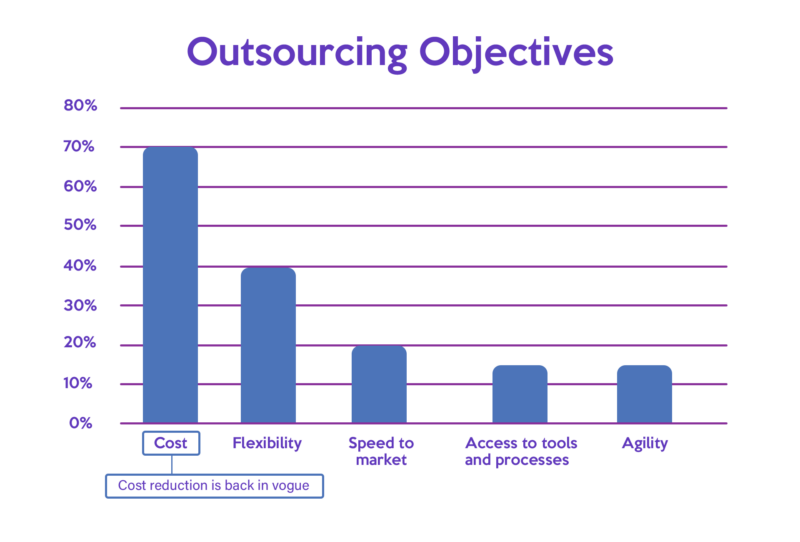

According to a Global Outsourcing survey by Deloitte, in the past, many people in the industry stated that cost reduction is a secondary benefit behind other business objectives such as agility or improving the quality of service. But in 2020, there was a sharp increase in the number of organizations giving priority to cost reduction, and in the face of a likely pandemic-induced global recession, the number will be greater.

Here are some of the areas where outsourcing can reduce the cost:

Workspace and Equipment

Keeping an in-house accounting department can be expensive. Requisitioning office supplies, furniture, and space for permanent employees is a common part of the costly hiring process. Rather than having to pay for these, by outsourcing, you can rely on the service provider to take care of these expenses.

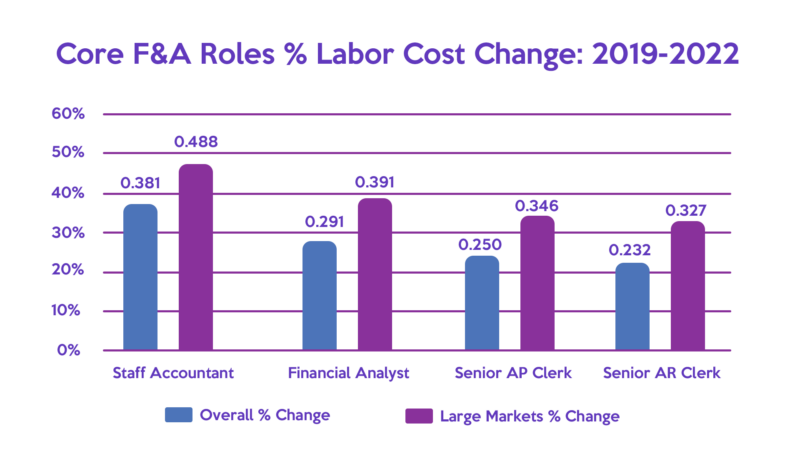

Labor Costs

One way of potentially achieving cost savings is through labor expenses. Many countries or regions have cheaper labor costs because of lower costs of living. By outsourcing some tasks and processes of the finance and accounting department, businesses can reduce overall labor expenses.

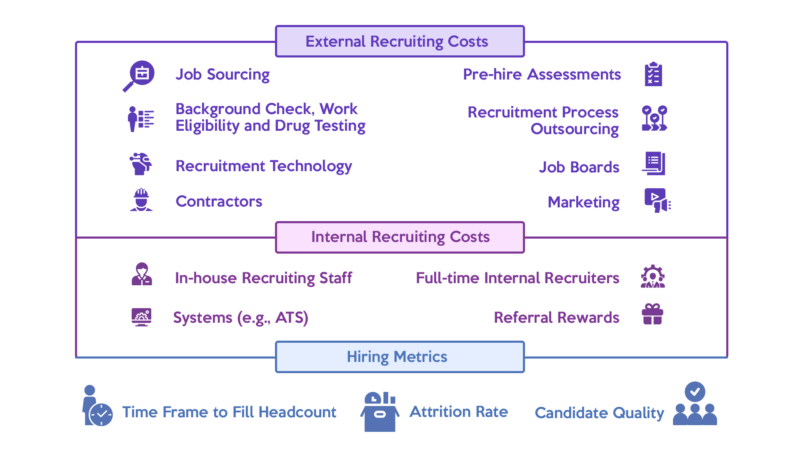

Hiring, Onboarding, and Training Costs

Staffing constraints often come with high recruitment and training costs. According to Glassdoor, an average U.S. employer spends about $4,000 and 24 days to hire a new employee. Recruiting and hiring include costs incurred from advertising to interviewing and screening candidates.

Linkedin, a networking site for job professionals, is one of the major sites for job hunters and recruiters. In the United States, the cost of a single 30-day premium job post can range from $15 to $1,000.

The business must also invest in employee assistance and training initiatives if they keep its finance and accounting department in-house. These costs can include employee time, materials, and administrative resources.

By outsourcing, however, companies can eliminate expenses such as office space, utilities, equipment, and maintenance costs. Service providers often have technological resources available which they offer to their clients as part of their service package. By leveraging these resources, businesses can reduce their capital expenses as they won’t have to invest in building out their own infrastructure.

Pillar 2: Access to Expertise

Many organizations do not have an internal accountant with expertise in all facets of accounting, including bookkeeping, taxation, financial compliance, etc. Even though businesses hire accountants to do payrolls, or update account books on a daily basis, they typically employ accounting and audit firms to complete their annual accounting procedures.

Good quality financial data that is timely, relevant, and easy to use must be available to support business decisions. Problems may arise that could potentially threaten the viability of the company due to poor accounting and decision-making based on inaccurate financial information.

Finance and accounting service providers have professionals who possess an in-depth understanding of accounting procedures, reporting standards, tax regulations, and compliance requirements. Because of their wide experience with different industries, they understand well the unique financial challenges and opportunities that exist within various industries, and they can offer helpful recommendations and solutions that are adapted to the particular setting.

Whether the business needs bookkeeping, payroll services, accounts payable, or a blend of services, outsourcing companies can provide experts who can handle complex tasks. Their expertise guarantees precise financial record-keeping, financial analysis, and compliance with regulatory requirements.

Pillar 3: Enhanced Scalability

Outsourced accounting allows small businesses to use resources typically only available to much larger organizations. The ability to outsource tasks “as needed” is one of its greatest advantages. Outsourcing companies are able to easily ramp up their capabilities and onboard new resources when a business experiences sudden growth or need to scale up its accounting functions. Their agility ensures that F&A operations can successfully handle rising transaction volumes, business expansion, or seasonal fluctuations without the need for significant hiring, training, or downsizing.

Pillar 4: Process Standardization and Compliance

Compliance with financial regulations and accounting standards are crucial for businesses, regardless of the industry they operate in. The standardization of processes ensures that F&A operations comply with regulatory requirements and industry standards; failure to do so may result in legal fines, reputational damage, and business disruption.

Financial regulations and compliance can be intricate and dynamic. Due to the various ways that each industry functions, each has specific financial reporting requirements.

F&A service providers have expertise in designing efficient workflows, implementing best practices, and ensuring consistent execution of tasks. They can carry out an in-depth risk analysis to find potential weak points and gaps in financial procedures. Outsourcing partners can establish effective risk management strategies and put in place the essential controls to minimize the likelihood of risks.

By following accounting compliance standards, companies can identify issues before they become major problems. In the long run, adhering to the relevant standards and principles saves the company time and money. It takes a lot less effort to follow the rules and comply with the regulations than it does to repair the damage caused by bad press, legal action, and fines.

Pillar 5: Focus on Core Competencies

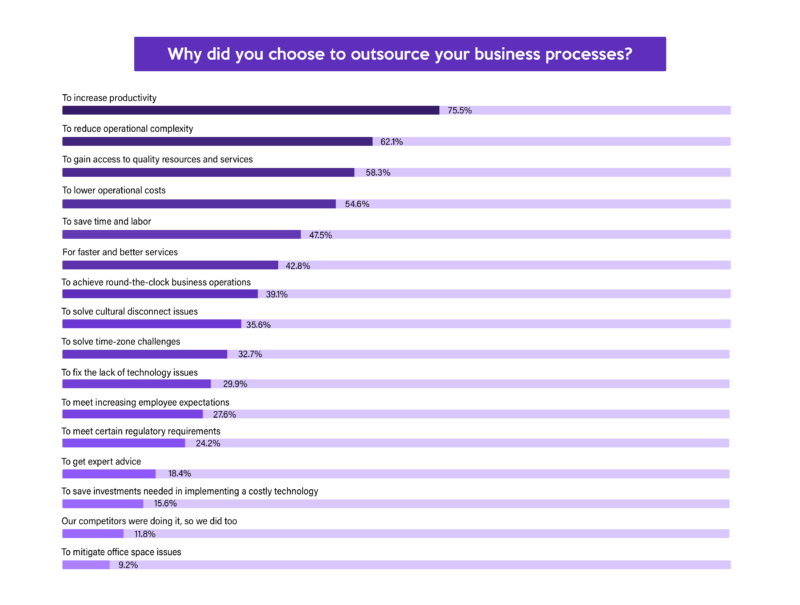

In a survey conducted by GoodFirms, 75.5% said that they choose to outsource business services to increase productivity. Many of these surveyed businesses commonly delegate non-essential aspects of their everyday operations to outside contractors. These functions are usually those that are excessively time-consuming or monotonous, such as advertising, hiring, accounting, etc.

Building an internal finance and accounting team offers control, but this also costs time and money. Businesses that outsource their finance functions can better focus on a certain facet of their operations. C-suite executives may concentrate on strategic decision-making, innovation, and promoting the overall growth of the company. They can free up the company’s resources to focus on the core competencies that set them apart from rivals and underpin their success.

The accounting industry is highly regulated, intricate, and susceptible to evolving laws and practices. Businesses looking to improve scalability and optimize their financial operations can build on the five pillars of outsourcing finance and accounting. These pillars are Cost Efficiency, Access to Expertise, Enhanced Scalability, Process Standardization and Compliance, and Focus on Core Competencies. Adopting these pillars enhances the company’s ability to maximize its financial operations, adjust to changing market conditions, and achieve long-term success in the competitive business landscape.

Leave A Comment

You must be logged in to post a comment.